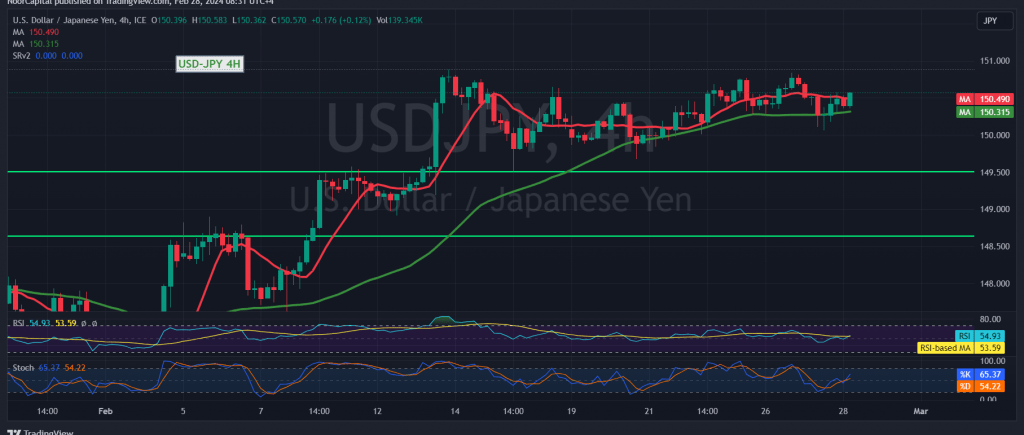

The USD/JPY pair successfully fulfilled the scenario outlined in the previous technical report, touching the first retest target at 150.10 and registering a low of 150.07.

From a technical standpoint, following the touch of the 150.10 support level, the pair exhibited a positive resurgence, signaling a bullish retracement. This resurgence is bolstered by the positive momentum of the 50-day moving average, further reinforced by favorable crossover signals from the momentum indicator.

Consequently, the prevailing bias leans towards an upward trajectory for the day, with an initial target set at 150.80. It is imperative to closely monitor the pair’s price action upon reaching this level, given its significance in shaping the immediate-term trend. A breakthrough at 150.80 would extend the gains, with subsequent targets set at 151.10 and 151.50, respectively.

Conversely, a return to trading stability below 150.10, particularly below 150.00, would reinvigorate the prospects of a decline towards the first official target at 149.40.

A word of caution: Today’s trading activity is influenced by the impending release of high-impact economic data from the American economy, specifically the preliminary reading of the gross domestic product – quarterly. Consequently, heightened volatility is anticipated at the time of the news release.

Moreover, it is essential to acknowledge the elevated risk environment associated with such events.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations