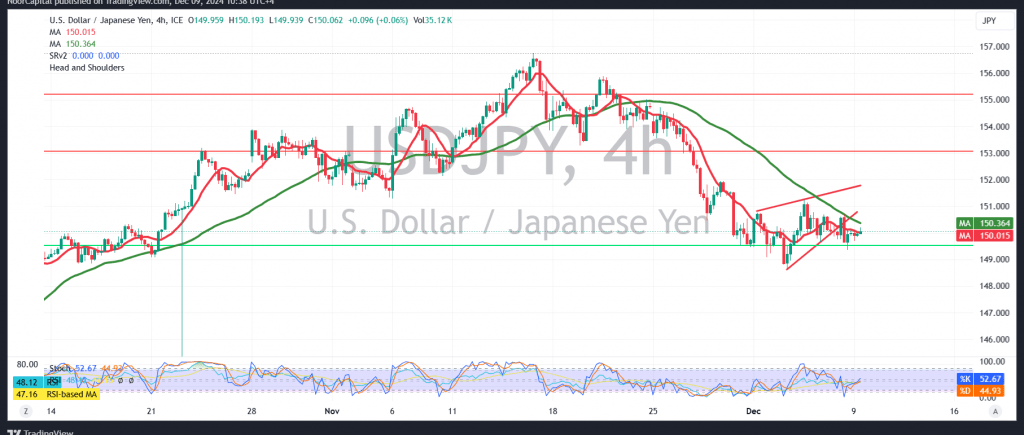

The USD/JPY pair adopted a neutral stance during the last technical report due to conflicting signals. However, the pair made negative trades, recording its lowest level at 149.36, near the mentioned support level last Friday.

Technically, today, we lean toward a bearish tendency but with caution, relying on the stability of daily trading below the pivotal resistance level located at 150.70, in addition to the negative pressure coming from the simple moving averages.

The bearish scenario remains the most likely during today’s session, targeting 149.40 as the first target. Breaking this level extends the pair’s losses, opening the way towards 148.70 initially.

As a reminder, the price’s stability above the resistance level of 150.75 could completely negate the bearish scenario. In this case, the pair may recover temporarily, targeting 151.40 and 152.00 levels.

Warning: The risk level is high and may not be commensurate with the expected return. Warning: The risk level is high amidst the ongoing geopolitical tensions, and all scenarios may be possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations