Analysis of Currency Pair Dynamics and Technical Indicators

The USD/JPY pair experienced positive trading dynamics at the outset of this week’s trading sessions, establishing a base near the critical support level at 148.20.

Market Dynamics

Positive Trades and Support Level

Positive trades dominated the movements of the USD/JPY pair, with buyers asserting control and establishing a base around the 148.20 support level. This indicates a favorable sentiment towards the pair at the beginning of the trading week.

Technical Analysis

Support from Simple Moving Averages

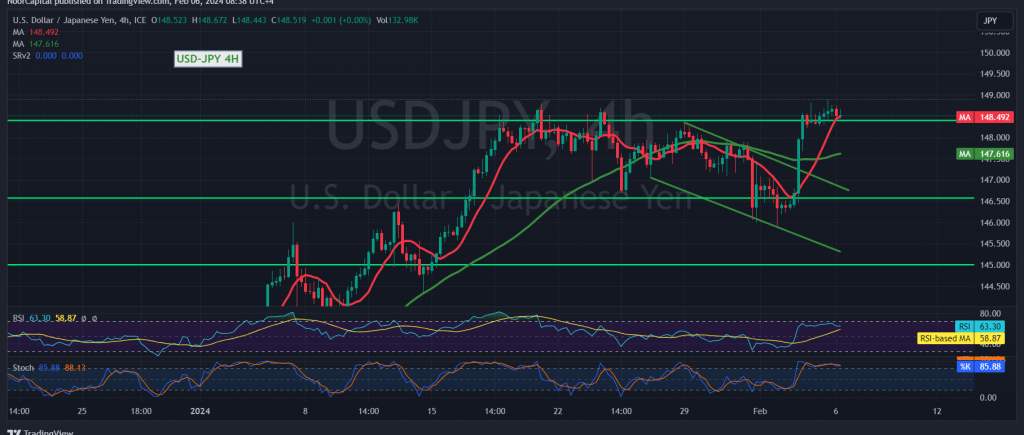

Upon closer examination of the 4-hour chart, the USD/JPY pair demonstrates technical indicators supporting further upside potential. Key observations include:

- Simple Moving Averages (SMAs): The SMAs have resumed their role of providing support to the price action, guiding the pair’s daily upward trajectory. Additionally, the pair is exhibiting trading stability above the support of the 50-day SMA, situated around 147.60.

Potential Scenarios and Targets

Continuation of Upward Trend

There exists a possibility of the USD/JPY pair sustaining its upward momentum. To activate this scenario, it is imperative for the pair to experience an upward leap and consolidate its price above the 148.85 level. If achieved, this could pave the way for the pair to target subsequent resistance levels at 149.20 and 149.60, respectively.

Bearish Pressure Scenario

Conversely, breaching the support level at 147.70 could subject the pair to strong negative pressure, potentially targeting the 147.40 level. Subsequent losses may extend towards 147.10.

Risk Assessment

High Risk Level

Market participants should exercise caution due to the inherent risks associated with trading. The dynamic nature of the forex market, coupled with potential geopolitical developments and economic data releases, contributes to an elevated risk level.

Conclusion and Tactical Considerations

Remaining Vigilant Amidst Market Dynamics

Traders should remain vigilant and adapt their strategies in response to evolving market dynamics. Monitoring key support and resistance levels, as well as staying informed about external factors impacting currency movements, will be essential for making informed trading decisions. Implementing effective risk management practices is crucial for mitigating potential losses and capitalizing on trading opportunities amidst the inherent volatility in the USD/JPY pair.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations