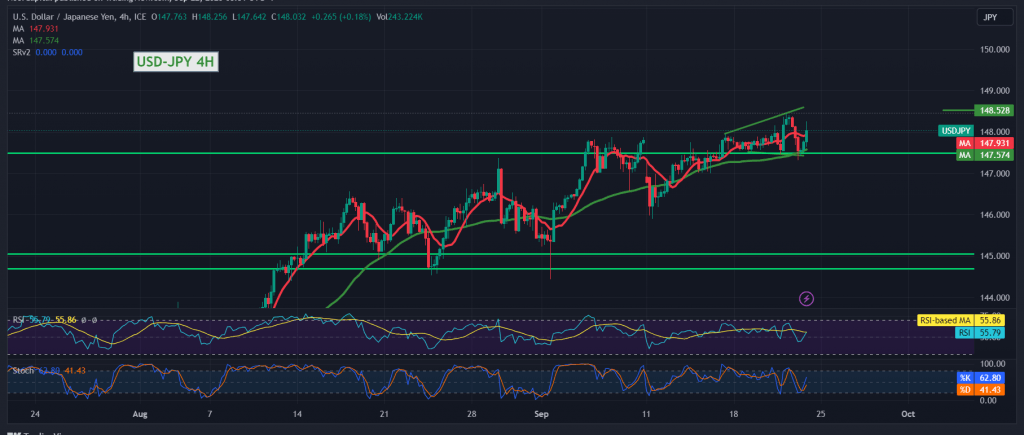

During the previous trading session, mixed movements dominated the USD/JPY pair, as it began to put pressure on the 147.70 support level, forcing it to maintain positive stability again.

On the technical side today, the 50-day simple moving average still supports the upward curve of prices, and this comes in conjunction with the positive crossover signals that began to appear on the Stochastic indicator on the 4-hour time frame.

For those who enjoyed the stability of daily trading above 147.50, the bullish scenario remains valid and effective, targeting 148.50, knowing that breaching it is a motivating factor that leads the pair to complete the upward path with targets starting at 149.00.

We remind you that sneaking below 147.50 postpones the chances of a rise but does not cancel them, and we may witness a bearish trend aimed at retesting 147.00 before attempts to rise again.

Note: Today we are awaiting high-impact economic data issued, the preliminary reading of the services and manufacturing PMI index in Europe, the UK and the US, and we may witness high fluctuation in prices at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations