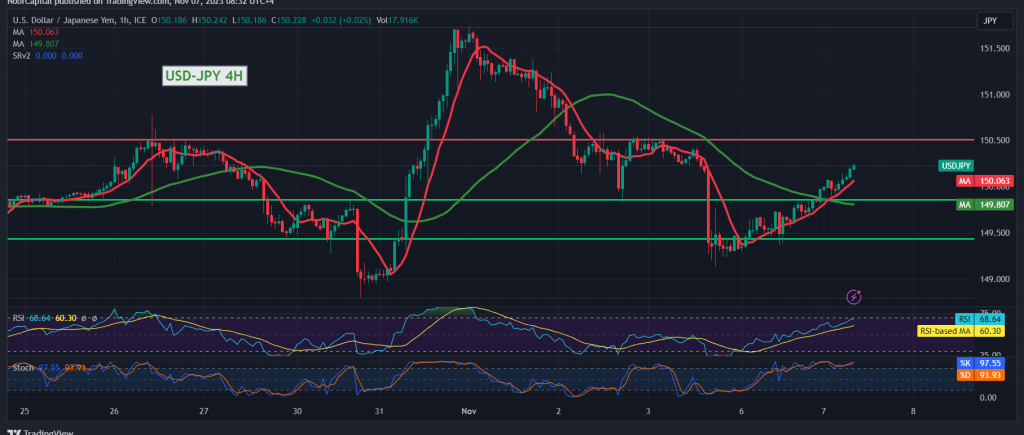

In the face of recent market fluctuations, the USD/JPY pair has shown a reversal in its anticipated downward trend, diverging from the expectations outlined in the previous report. Despite the current upward momentum, the pair is struggling to breach the critical psychological resistance level at 150.55, with the Stochastic indicator signaling overbought conditions.

As of now, the pair’s stability below 150.55 suggests a potential bearish scenario for the day ahead. The initial target in this scenario lies at 149.55, and a successful breach could further strengthen the bearish momentum, setting the stage for a move toward the 149.00 level.

Conversely, an upward breakout and sustained consolidation above 150.55 would invalidate the bearish outlook, opening the door for the pair to reclaim ground. In such a scenario, the initial target would be set at 150.90.

Traders should closely monitor the price action around these key levels, as they hold the key to the short-term direction of the USD/JPY pair.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations