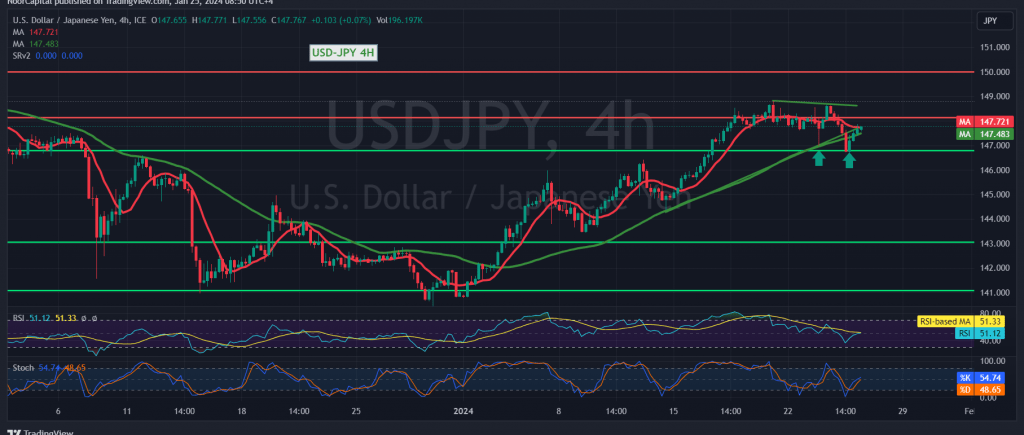

The USD/JPY pair experienced a prevalence of negative trades in line with the anticipated downward trend, reaching its lowest point at 146.65 in the previous session.

In today’s technical analysis, a closer examination of the 240-minute timeframe chart reveals a notable support foundation around 146.65. This support effectively mitigated the bearish momentum, facilitating consolidation at this level. Additionally, the return of the 50-day simple moving average from below has contributed to supporting the current price.

A positive outlook is plausible, contingent on a distinct and robust breach of the resistance level at 147.80. Such a breakthrough is likely to propel the pair on an upward trajectory, with initial targets set at 148.50, followed by 148.80.

It is essential to remain vigilant, with a return to trading stability below 146.65 potentially reinstating negative pressure on the pair. In such a scenario, downside targets include 146.10 and subsequently 145.80.

Investors are advised to exercise caution today, given the anticipation of high-impact economic data from the Eurozone, including the European Central Bank Monetary Policy Committee statement, interest rate announcements, and the press conference by the President of the European Central Bank. Consequently, significant price fluctuations may be observed during the news release period.

Furthermore, it’s important to acknowledge that the risk level may be elevated, and prudent risk management practices are recommended in the current market environment.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations