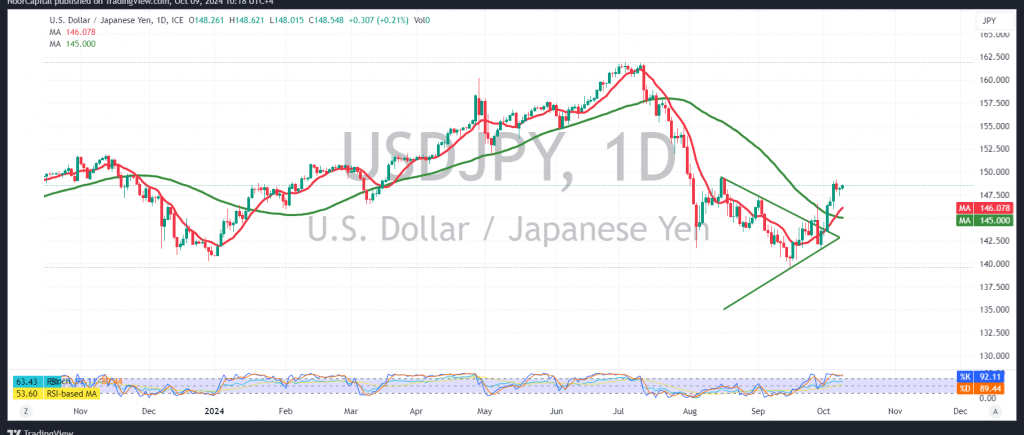

The USD/JPY pair experienced a significant rise in line with the positive outlook from the previous report, surpassing the official target of 145.20 and reaching a high of 148.62.

From a technical standpoint, we maintain a cautiously positive outlook today. The 240-minute chart shows continued support from the simple moving averages, along with confirmation of the break above the downtrend resistance at 148.50.

With intraday trading holding above 147.70, the bullish bias remains intact, and a confirmed breach of the 149.00 level could extend gains toward the next target at 149.50. Further momentum could push the pair toward 150.25.

On the downside, a close below 147.70 on the hourly chart would halt the upward momentum, opening the door to negative pressure with an initial target at 146.90 before any further attempts to rise.

Warning: The risk level is high and may not align with the expected return.

Alert: We are awaiting high-impact economic data from the US, including the “Federal Reserve Committee meeting results,” which could result in significant price volatility.

Risk Alert: The risk remains elevated amid ongoing geopolitical tensions, and all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations