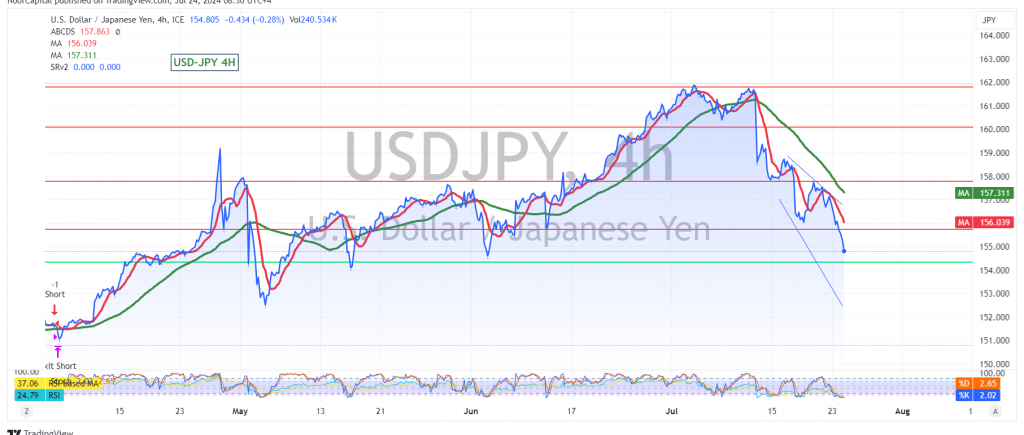

The USD/JPY pair experienced an accelerated downward trend, surpassing the targeted levels of 155.80 and 155.30, and reaching a low of 154.76 during early trading in today’s session.

From a technical analysis perspective, the outlook remains negative, as the pair continues to receive bearish signals from the simple moving averages and the Relative Strength Index (RSI).

Given these indicators, a corrective decline appears likely, with an initial target at 154.05. A break below this level could extend losses towards 153.30.

On the upside, if the pair stabilizes above 156.40, this could halt the downward trend and potentially lead to a recovery towards 157.95 and 158.60.

Warning: The level of risk is high and may not be proportional to the expected return.

Warning: Today’s trading session may experience significant price volatility due to high-impact economic data releases, including the preliminary readings of the services and manufacturing PMI indices from the Eurozone, the United Kingdom, and the United States, as well as the Canadian interest rate decision and the Bank of Canada’s press conference.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations