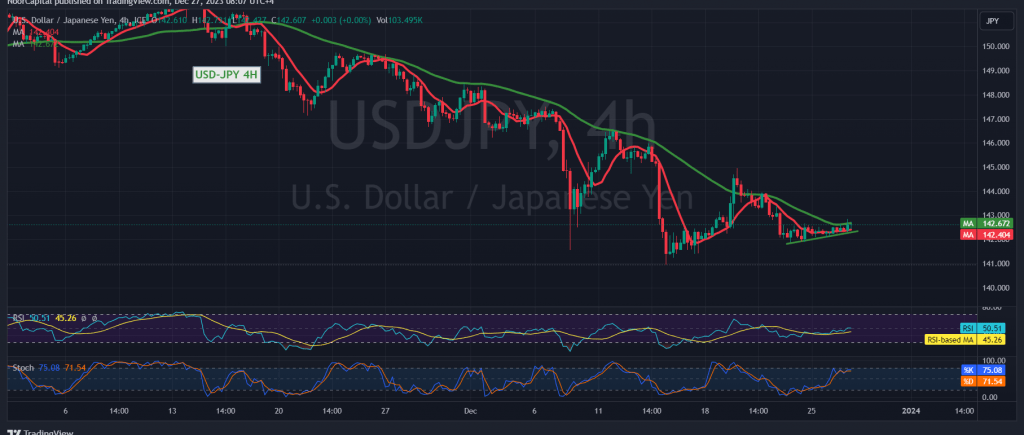

The USD/JPY pair presented positive trades during the previous trading session, but positivity was still limited, recording its highest level at 142.85.

Technically, the pair found a strong resistance level around 142.85, which succeeded in reducing the upward tendency. With a closer look at the 60-minute interval chart, we find the pair stable above the 50-day simple moving average. On the other hand, we find negative features still dominating the Stochastic indicator.

With conflicting technical signals, we prefer to monitor the price behavior of the pair to be faced with one of the following scenarios:

To obtain an upward trend, this requires that we witness the price consolidation above 142.90, which is a motivating factor that increases the possibility of touching 143.25 as the first target, and then 143.70.

To obtain a downward trend, this depends on confirming the break of the strong support floor 142.15, and from here the pair returns to the official bearish path, with targets starting at 141.75 and later extending towards 141.40.

Warning: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations