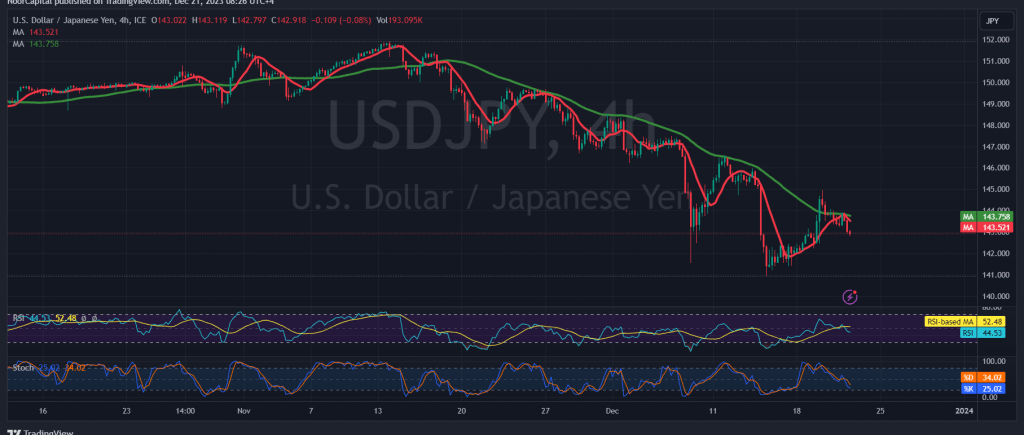

Negative trading has regained control over the movements of the USD/JPY pair, aligning with the bearish expectations outlined in the previous technical report. The pair touched the initial target at 142.90, marking its lowest point at 142.80.

From a technical standpoint, a prevailing bias towards negativity is observed, sustained by the persistent downward pressure exerted by the simple moving averages, which continue to impact the price from above. Additionally, negative signals from the Relative Strength Index, stemming from stability below the 50 midline, contribute to the bearish sentiment.

In the forthcoming hours, a bearish bias is anticipated, targeting 142.45. It is noteworthy that a breach below this level intensifies the pair’s negative pressure, prompting a look towards 141.90.

Conversely, an upward move and price consolidation above 143.75 have the potential to disrupt the proposed scenario, paving the way for a rapid ascent towards 144.60.

Cautionary Note: Today, heightened attention is warranted as we await the release of high-impact economic data from the American economy—the “final reading of gross domestic product” for the quarter. Consequently, expect increased price fluctuation during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations