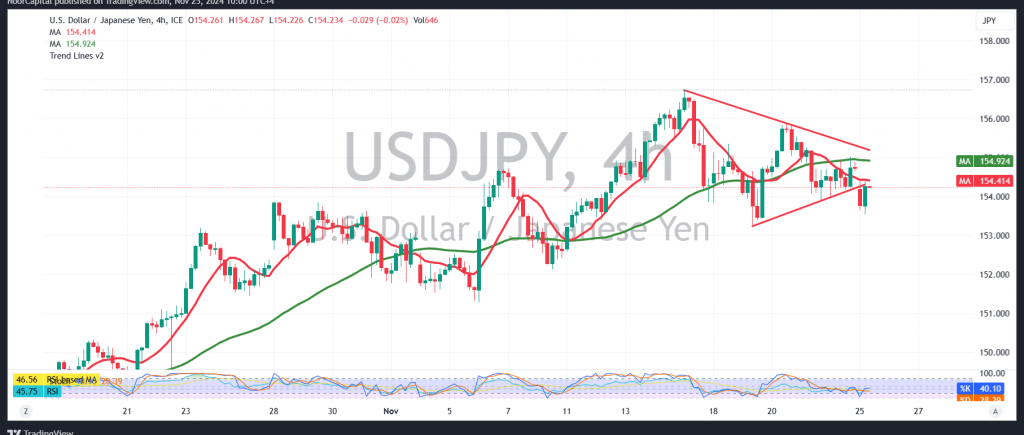

The USD/JPY pair successfully reached the bearish target outlined in the previous analysis, touching 153.80 and recording a low of 153.55.

Technically, the pair remains under consistent downward pressure, trading below the critical resistance level of 155.10. This is reinforced by negative momentum from the simple moving averages and bearish signals from the RSI, supporting the continuation of the decline.

Given these conditions, a further bearish correction remains likely, with initial targets at 153.75. A break below this level would accelerate the downward movement, paving the way toward 153.20 and potentially extending losses to 152.80.

On the upside, a sustained recovery above 155.10 would invalidate the bearish scenario, setting the stage for the pair to resume its upward trend, targeting 155.50.

Warning: Trading risks are elevated and may not align with the potential returns. Geopolitical tensions remain a significant factor, leaving all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations