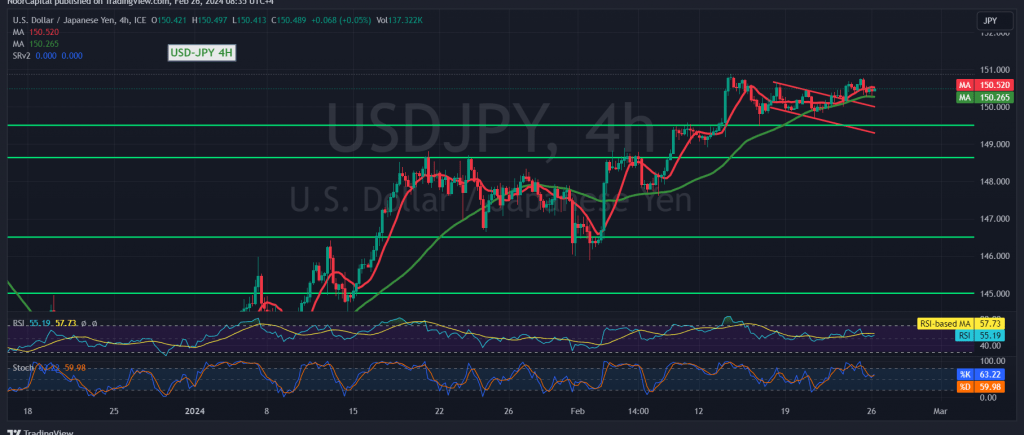

The USD/JPY pair has successfully maintained its positive trajectory, in line with our expectations outlined in the previous technical report, with the pair reaching the initial official target of 150.80 and peaking at 150.77.

Today, the technical outlook remains consistent, with no significant deviations observed in the pair’s movements. Technically, we lean towards a positive bias, bolstered by the price receiving positive momentum from the 50-day simple moving average, coupled with the bullish structure evident on the 4-hour chart.

With daily trading holding firm above 150.10, the upward trend is favored, targeting 150.80 as the initial objective, followed by 151.10 as the next official station. Further extensions of these targets towards 151.50 could materialize later on.

Conversely, breaching below 150.10, particularly 150.00, introduces negative pressure on the price, potentially triggering a bearish sentiment aimed at retesting 149.65 before any renewed upward attempts.

Warning: The level of risk involved may be elevated, and traders should exercise caution accordingly.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations