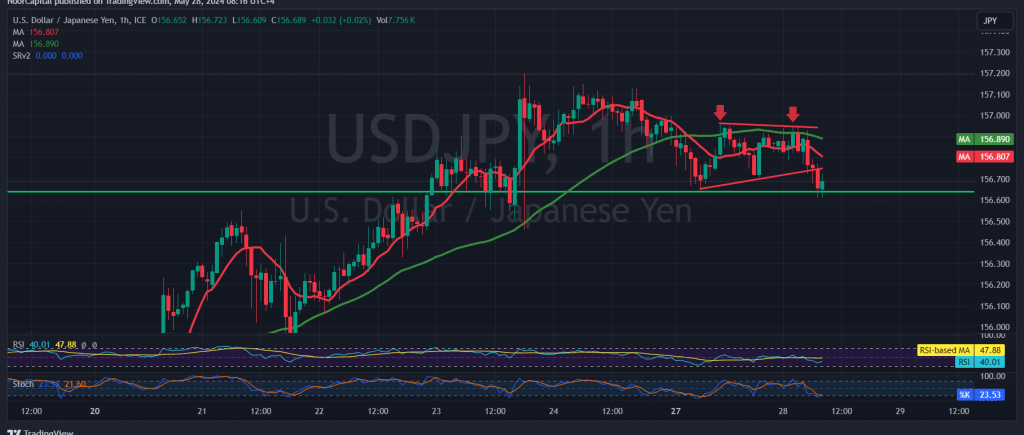

The USD/JPY pair continues to experience narrow, sideways trading with a slight bearish tilt following yesterday’s failed attempt to hold above the critical 157.00 level.

Technical Indicators Suggest Potential Downside

A closer look at the 4-hour chart reveals emerging signs of weakness. The Stochastic indicator is gradually losing upward momentum, and the price remains below the psychological resistance of 157.00, and more importantly, 157.10.

Downside Targets and Support Levels

A cautious bearish outlook is warranted, with initial targets of 156.40 and then 156.10. However, traders should be aware that a decisive break below 156.10 could trigger significant downward pressure, potentially leading to a retest of 155.55 before any recovery attempts.

Upside Risks and Resistance Levels

It’s important to note that a surge above and a consolidation above 157.15 could quickly reignite the bullish momentum, leading to a potential recovery towards 157.40 and 157.80.

Important Note: Today’s release of the US Consumer Confidence Index could introduce significant volatility into the market. Traders should exercise caution and be prepared for potential price fluctuations around the news release.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations