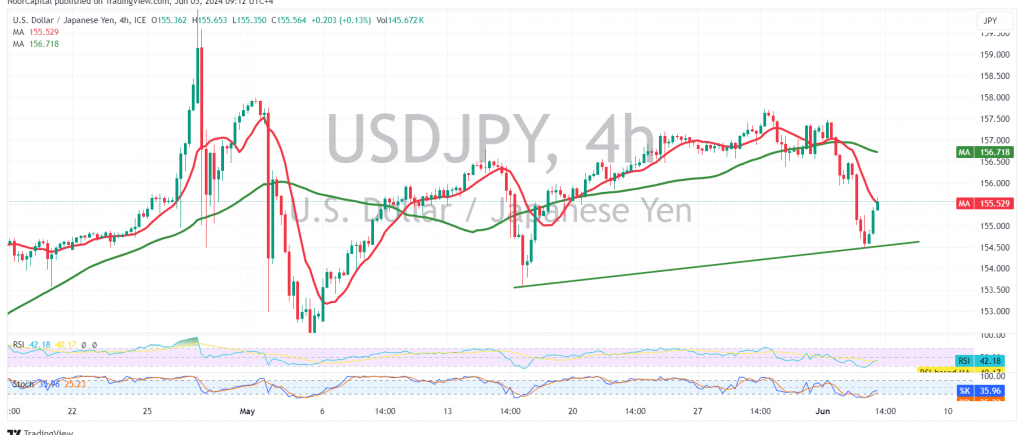

The USD/JPY pair has activated the anticipated bearish scenario, surpassing the targeted level of 155.50 and reaching a low of 154.55. However, technical indicators suggest the possibility of a rebound in the near future.

On the 240-minute timeframe chart, the pair is currently hovering around the 155.50 support level. The Stochastic oscillator is attempting to regain upward momentum, which could propel the pair higher.

A potential upward bias may emerge in the coming hours, with the pair potentially retesting the 156.55 resistance level, followed by the 157.50 level.

However, traders should remain cautious as a decisive move below 154.60 could reignite the downward momentum, targeting 153.60 and 152.60 as potential support levels.

The risk level remains high, especially with the impending release of high-impact economic data from the U.S. economy, specifically the “Change in Non-Agricultural Private Sector Jobs” report. This data could trigger significant volatility in the market, influencing the USD/JPY pair’s direction.

In conclusion, the USD/JPY pair is currently at a critical juncture. While a rebound is possible, a confirmed break below 154.60 could lead to further declines. Traders are advised to closely monitor the price action around these key levels and be prepared for potential volatility due to the upcoming economic data release.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations