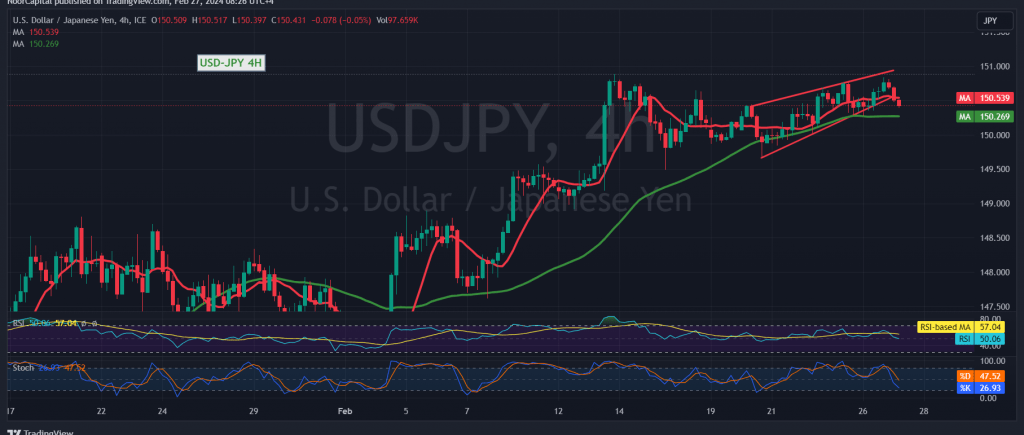

The dollar/yen pair reached the initial target specified in the previous technical report, attaining the price of 150.80, which emerged as a robust resistance level, impeding further upward momentum.

Today’s technical analysis, upon closer examination of the 4-hour chart, reveals the pair encountering the formidable resistance at 150.80, as denoted by the previous target. Furthermore, indications of bearish sentiment are beginning to manifest on the Stochastic indicator, signaling a gradual loss of upward momentum.

In the forthcoming hours, there is a likelihood of a bearish bias emerging, with an initial target set at 150.10. It is imperative to closely monitor the pair’s price action around this level, given its significance in relation to the prevailing short-term trend. A breach below 150.10 could extend the downturn, potentially revisiting 149.70.

It is noteworthy that a resurgence of trading stability above the robust resistance level of 150.80 would promptly quell the bearish sentiment, paving the way for the pair to resume its upward trajectory towards 151.10 and 151.50, respectively.

A cautionary note: Today’s trading landscape is fraught with anticipation for influential economic data from the American economy, particularly the “Consumer Confidence Index,” which may trigger heightened volatility upon its release.

Moreover, it is essential to acknowledge the elevated risk environment.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations