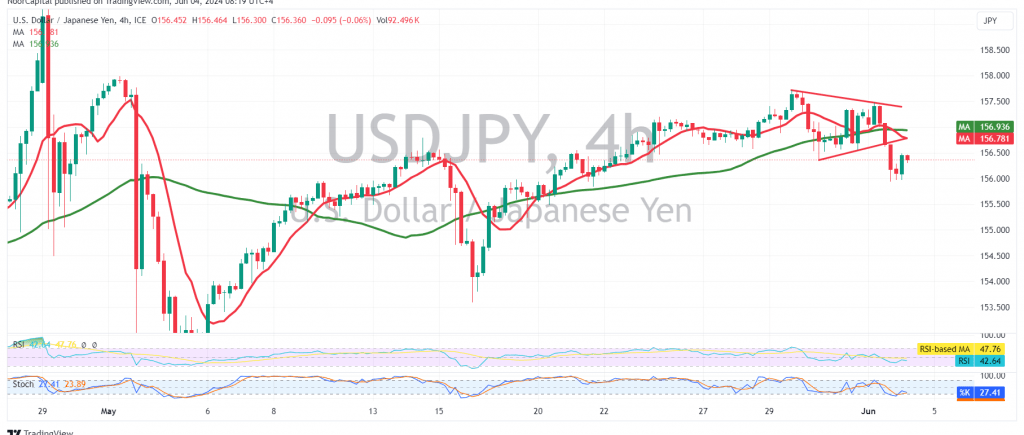

The USD/JPY pair experienced mixed trading following an attempt to regain upward momentum. However, the pair faced resistance at 157.45, leading to a slowdown in its upward trajectory.

Technical analysis on the 4-hour chart reveals a potential shift in sentiment. The pair struggled to maintain its position above the 157.00 barrier, and a negative crossover is emerging on the simple moving averages. Additionally, the upward momentum has begun to wane.

These signs suggest a possible bearish bias in the upcoming trading sessions. The pair could retest the crucial support level of 155.50, which serves as a key indicator for the overall upward trend.

Traders should pay close attention to the 156.85 and 157.00 levels. A return of trading stability above these levels could negate the bearish outlook and reignite the upward movement, with potential targets at 158.10 and 158.70.

However, caution is advised, as the U.S. economy is scheduled to release high-impact economic data, including job vacancies and labor turnover rate figures. These announcements could introduce significant volatility into the market, potentially impacting the USD/JPY pair’s direction.

In conclusion, while the USD/JPY pair has recently shown bullish momentum, the current technical indicators suggest a possible reversal. Traders should closely monitor the key support and resistance levels mentioned above and be prepared for potential volatility due to the upcoming economic data release.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations