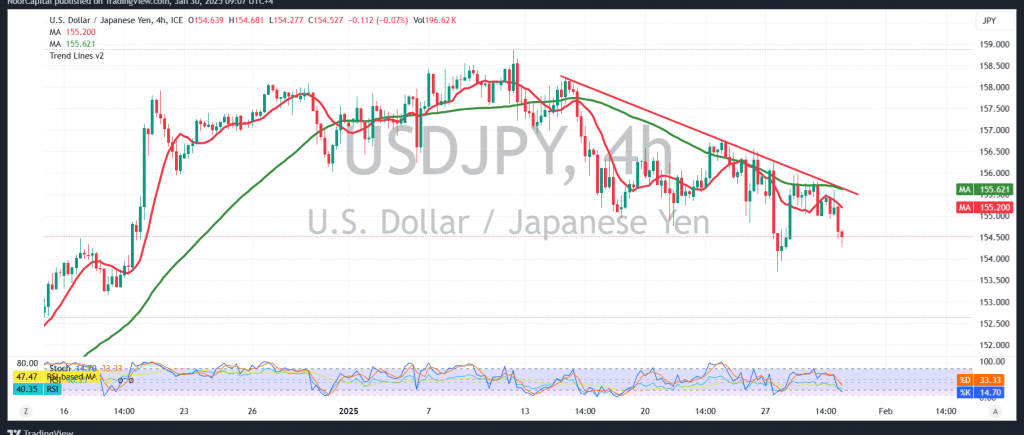

In our previous analysis, we maintained a neutral stance, emphasizing the importance of monitoring price behavior. The pair has since broken below 155.50 and more importantly 155.00, confirming a bearish outlook.

Technical Outlook:

- The 50-day simple moving average is exerting downward pressure.

- The Relative Strength Index (RSI) is showing clear negative signals, reinforcing bearish sentiment.

Key Levels to Watch:

- Bearish Scenario:

- A break below 154.00 could extend losses toward 153.40 and 152.50.

- Bullish Scenario:

- Stability above 155.50 would invalidate the bearish outlook, potentially triggering a recovery.

Market Risks & Upcoming Data:

- High-impact events today include the European Central Bank’s monetary policy statement, interest rate decision, and ECB President’s press conference, which may cause high volatility in the forex market.

Risk Warning: With geopolitical uncertainties at play, all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations