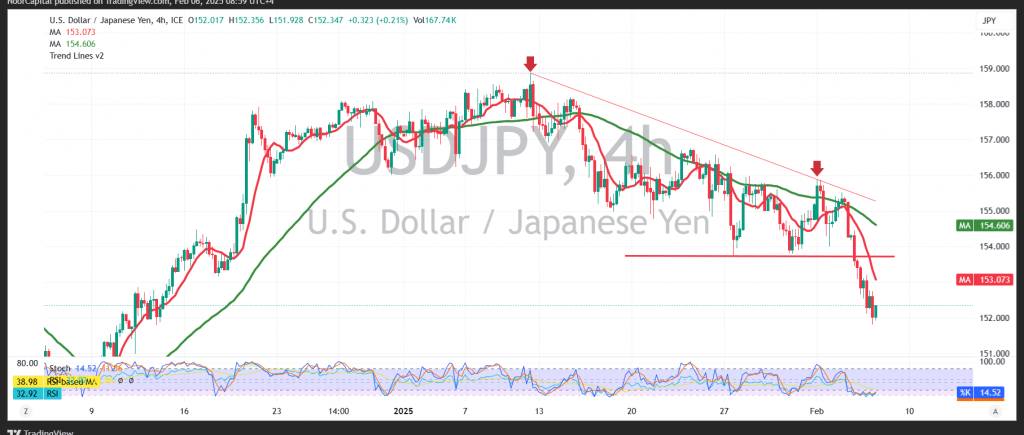

The USD/JPY pair declined after encountering resistance at 154.50, forcing a downward move to 151.81.

Technical Outlook:

- The break of 152.60 suggests continued selling pressure.

- The 50-day SMA acts as a negative catalyst for further downside.

- A bearish double top pattern reinforces the bearish bias.

Key Levels to Watch:

- Bearish Scenario:

- Sustained trading below 153.70 could push the pair toward 151.10.

- Bullish Scenario:

- A break above 153.70 may invalidate the bearish outlook, with recovery toward 154.50 possible.

Market Risks & Considerations:

- Geopolitical risks and U.S. economic data could trigger unexpected volatility.

- Bank of Japan’s stance on currency intervention remains a key factor.

⚠ Risk Warning: High uncertainty prevails, and rapid price fluctuations are possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations