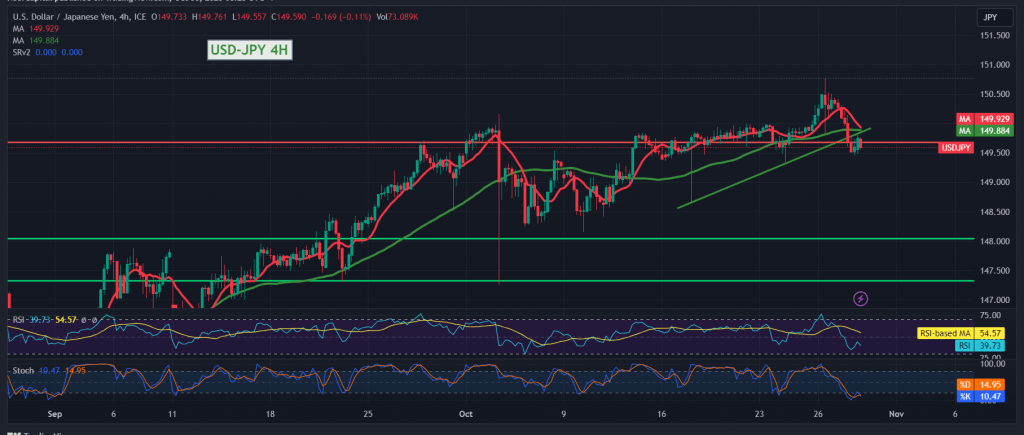

Last week, the dollar/yen pair surged to a high of 150.40, breaking the psychological barrier of 150.00. However, the trend swiftly reversed as stability dipped below this crucial level, steadying at 149.60.

From a technical standpoint, the pair currently lacks support from the ascending channel, facing downward pressure from the simple moving averages above.

Today, there’s a possibility of a downward correction, targeting 149.20 initially and then 148.65, unless the price consolidates above 150.00, especially 150.20. A decisive move upward and consolidation above 150.20 could negate the potential correction, allowing the pair to regain momentum within the established upward trend, with targets starting at 150.70.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations