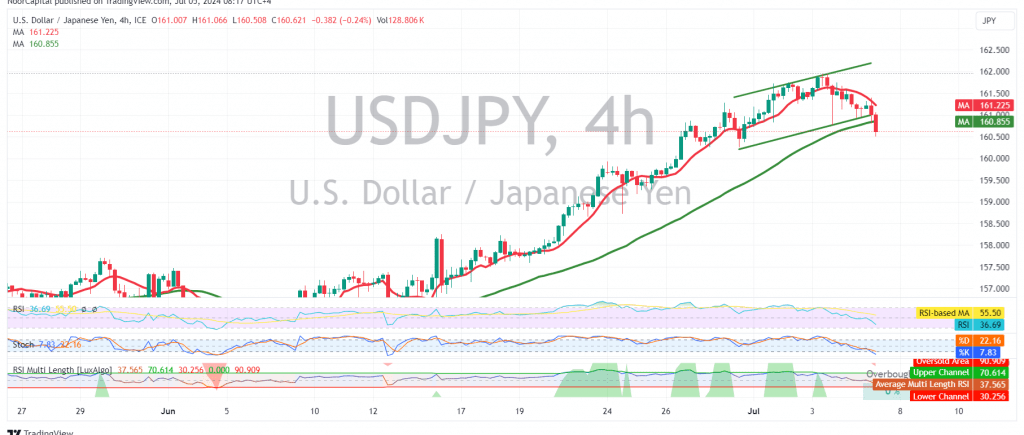

The USD/JPY pair has encountered strong resistance around the 161.70 level after a series of upward movements, resulting in a temporary halt to the bullish trend. The pair is currently consolidating around 160.60.

Technical Outlook:

On the 4-hour chart, the price is trading below the 50-day simple moving average (SMA), a key indicator suggesting potential downward pressure. Additionally, the Stochastic oscillator has lost its upward momentum, further supporting a bearish bias.

Downside Potential:

In the coming hours, we may witness a bearish correction, with an initial target of 160.20. Further declines towards 159.80 and 159.40 are possible if the bearish momentum intensifies.

Upside Potential:

However, a break above the 161.40 resistance level could invalidate the bearish scenario and reignite the upward trend, targeting 162.00 and 162.50.

Key Levels:

- Resistance: 161.40, 162.00, 162.50

- Support: 160.60, 160.20, 159.80, 159.40

Important Note:

The release of high-impact U.S. economic data today, including non-farm payrolls, unemployment rate, and average hourly earnings, could induce significant price volatility. Traders should exercise caution and closely monitor the market’s reaction to these news releases.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations