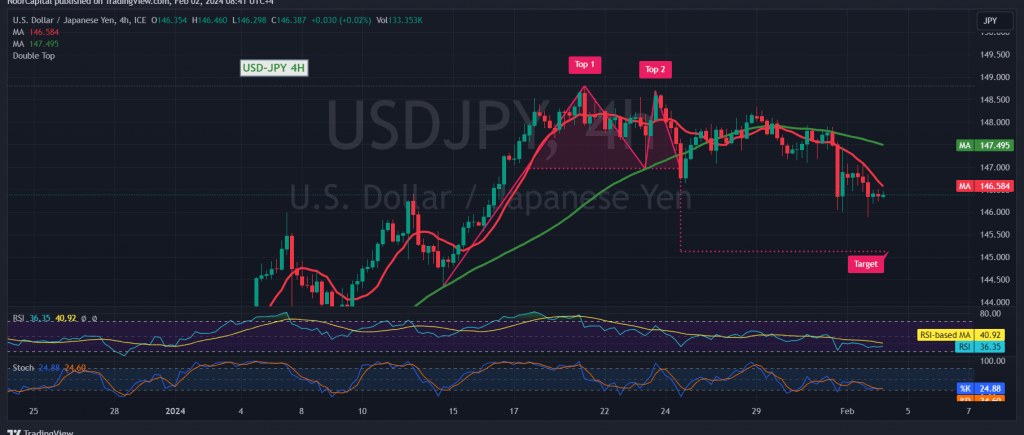

The dollar/yen pair experienced a predominance of negative trading during the previous session, aligning with our earlier expectations as it approached the officially targeted level mentioned in the prior report, reaching the lowest point at 145.89 against the yen.

In today’s technical analysis, the price remains below the simple moving averages, reinforcing the daily bearish trajectory. Additionally, clear negative signals on the Stochastic indicator indicate a gradual loss of upward momentum.

There is a possibility of a continued bearish trend in the coming hours, with an initial target set at 145.80. A break below this level could extend the pair’s losses, with the next official station at 145.25.

However, a reversal from the current bearish sentiment would be signaled by an upward cross and consolidation above the psychological barrier resistance level of 147.00. This move would immediately halt the potential decline, leading the pair to resume its upward trajectory. Targets in this scenario include 147.70 and 148.20, respectively.

It’s important to exercise caution today, especially with the anticipation of high-impact economic data on the American economy, specifically the “NFP, average wages, and unemployment rate.” Given the potential for significant price fluctuations during the news release, traders are advised to be cautious.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations