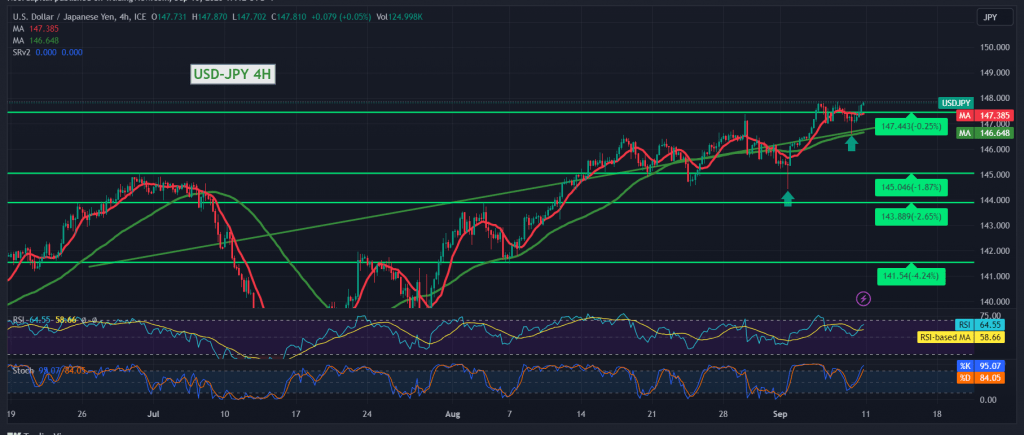

A gradual rise to the top within the positive outlook was published during the previous technical report, bringing the dollar/yen pair closer to the first target station of 148.00, only to record its highest level of 147.87.

Looking closely at the 240-minute time frame chart, we find that the pair has returned to stability above 147.00 and remains stable above the 50-day simple moving average, in addition to the positive momentum signals from the 14-day momentum indicator.

With the stability of intraday trading above 147.00, the bullish scenario remains valid and effective, targeting 148.00. The price behavior of the pair at the mentioned level must be monitored because breaching it is a motivating factor that enhances the pair’s gains, so we are waiting for 148.35 and 148.70; official stations are awaited.

From below, the return of daily trading stability below 147.00 postpones the chances of a rise, but does not cancel them, and we may witness a retest of 146.60 before the rise begins again.

Note: The Stochastic indicator is currently overbought, and we may witness fluctuations until we obtain the desired official direction.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations