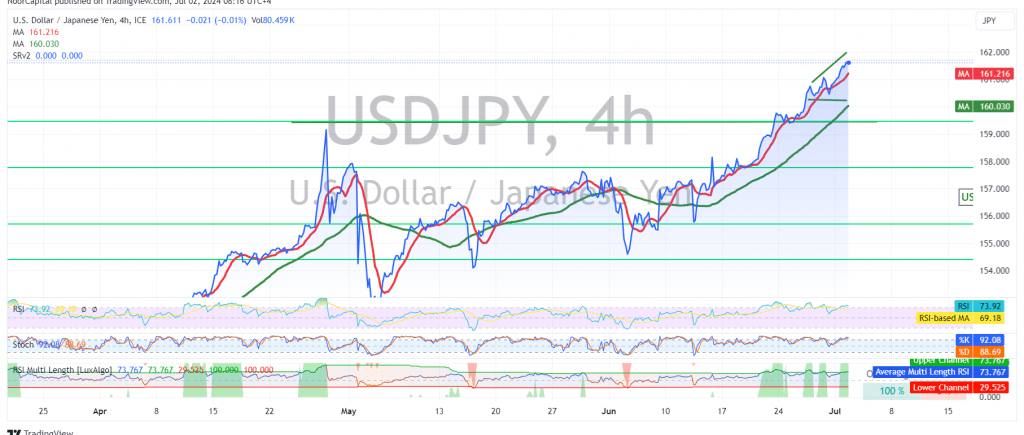

The USD/JPY pair continues its upward trajectory, breaking through the 161.00 psychological barrier and reaching a new high of 161.72.

Technical Outlook:

On the 240-minute chart, the Relative Strength Index (RSI) remains strong, indicating continued buying pressure. The simple moving averages (SMAs) are also providing positive momentum, reinforcing the bullish outlook.

Upward Potential:

With the price firmly above the 160.95 support level, the upward trend is expected to persist. The initial target is 162.00, and a break above this level could accelerate the rally towards 162.40 and 163.00.

Downside Risks:

However, traders should remain cautious as a drop below 160.95 could trigger a temporary correction, potentially targeting 159.30 and 159.90.

Key Levels:

- Support: 160.95, 159.30, 159.90

- Resistance: 162.00, 162.40, 163.00

Important Note:

The release of high-impact U.S. economic data today, including the JOLTS report and a speech by the Federal Reserve Chairman, could induce significant price volatility. Traders are advised to closely monitor market reactions to these news releases.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations