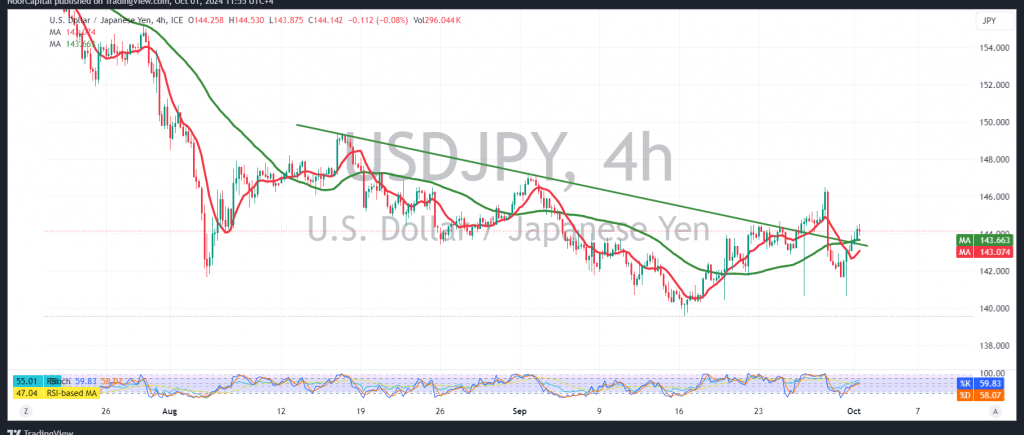

The USD/JPY pair experienced a strong bullish rebound after touching the pivotal support at 141.65, reaching a peak of 144.53 during early trading in today’s session.

Technically, analyzing the 240-minute chart, we maintain a cautiously positive outlook, supported by the momentum from the simple moving averages and the confirmation of breaching the downtrend resistance.

As long as intraday trading remains above 143.30, we maintain our positive expectations, with the next significant target at 145.20 as the upcoming stop.

However, should the hourly candle close below 144.30, this would halt the bullish attempts, potentially leading to a negative session, with possible declines towards 142.30 and 140.60.

Warning: The risk level is high and may not align with the expected return.

Warning: Today, we expect high-impact economic data from the US, specifically the “Job Vacancies and Labor Turnover” report, which may trigger substantial price volatility.

Warning: The risk level remains elevated amid ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations