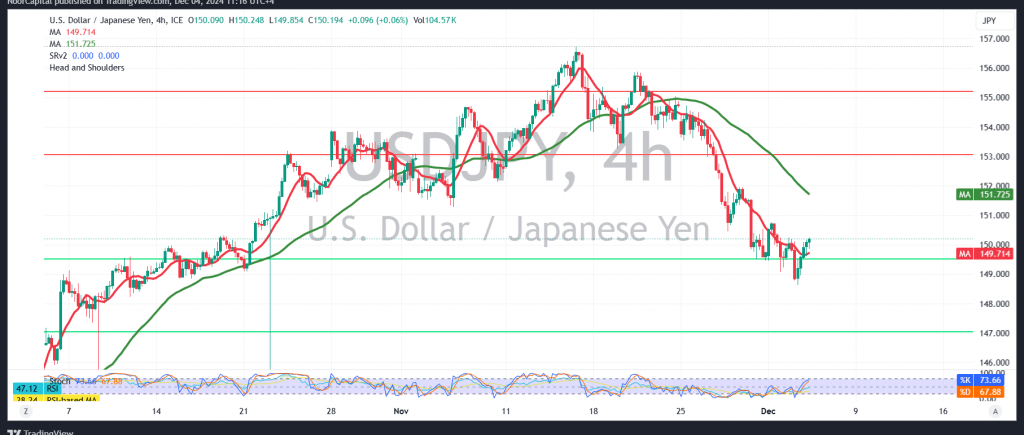

The USD/JPY pair shows a weak upward trend, with the pair currently hovering near its session high of 150.10 during early trading.

Technical Analysis:

The pair is under stable negative pressure below the key resistance level of 150.20. This pressure is reinforced by the negative influence of the simple moving averages and bearish signals from the relative strength index, supporting a potential decline.

Scenario Analysis:

- Bearish Case: The downward trend may persist, with initial targets at 149.10. A break below this level could intensify bearish momentum, opening the path toward 148.10 as the next expected target.

- Bullish Case: A decisive break above the key resistance level of 150.20 would invalidate the bearish outlook, allowing the pair to recover with targets at 150.65 and 151.20.

Warning: The release of high-impact U.S. economic data, including “Non-Farm Private Sector Jobs Change,” “ISM Services PMI,” and a speech by Federal Reserve Chairman Jerome Powell, could lead to significant price volatility.

Warning: Elevated risk levels amid ongoing geopolitical tensions mean that all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations