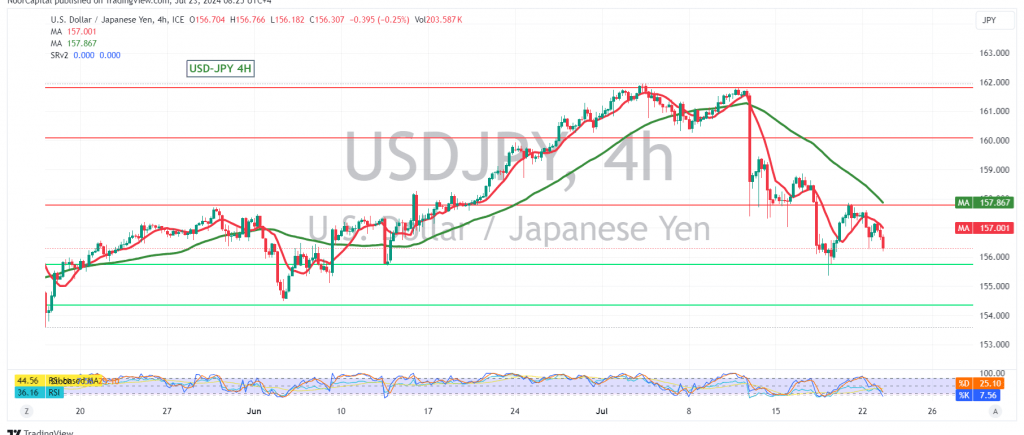

The USD/JPY pair continues its downward trajectory, pressuring the key support level at 156.80. Technical indicators suggest a bearish bias, with the potential for further decline.

Technical Outlook:

- Negative SMA Crossover: The simple moving averages have formed a negative crossover, indicating increased selling pressure.

- Loss of Upward Momentum: The Stochastic oscillator has lost its upward momentum, further reinforcing the bearish sentiment.

Downside Potential:

A corrective decline appears likely, with an initial target of 155.80. If this support level is breached, the pair could extend its losses towards 155.30.

Potential Reversal:

However, a return of trading stability above 156.80, and more importantly, a sustained move above 157.20, could halt the downward trend and initiate a recovery towards 158.10 and potentially 158.60.

Key Levels:

- Support: 156.80, 155.80, 155.30

- Resistance: 157.20, 158.10, 158.60

Important Note:

The risk level remains high, and potential returns may not be proportional to the risks involved. Traders should exercise caution and closely monitor price action around the key levels.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations