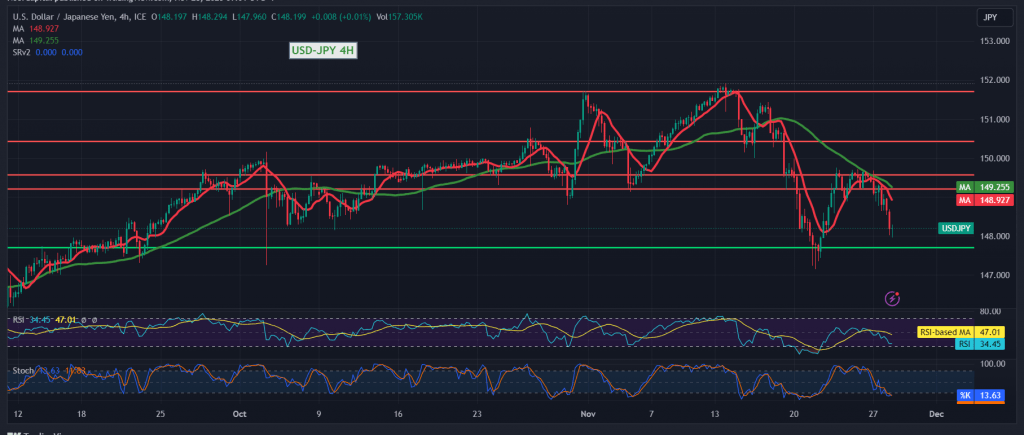

The USD/JPY pair experienced a significant decline in the previous trading session, surpassing the official target at 148.30 and reaching a low of 147.97.

From a technical perspective today, when examining the 60-minute time frame chart, there is observed stability in intraday trading below the previously breached support at 148.30. This is accompanied by negative pressure from the simple moving averages, supporting the continuation of the downward correction.

The potential for a downward trend remains valid, with a target at 147.55. It’s noteworthy that breaking below this level could lead the pair to resume its downward corrective path, with an official target at 146.90.

On the upside, the return of trading stability at 149.20 would completely invalidate the proposed scenario, leading to an upward trend with targets at 150.30 and 150.60, respectively. Traders are advised to monitor key support and resistance levels, as well as additional technical indicators, for a comprehensive understanding of the market conditions.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations