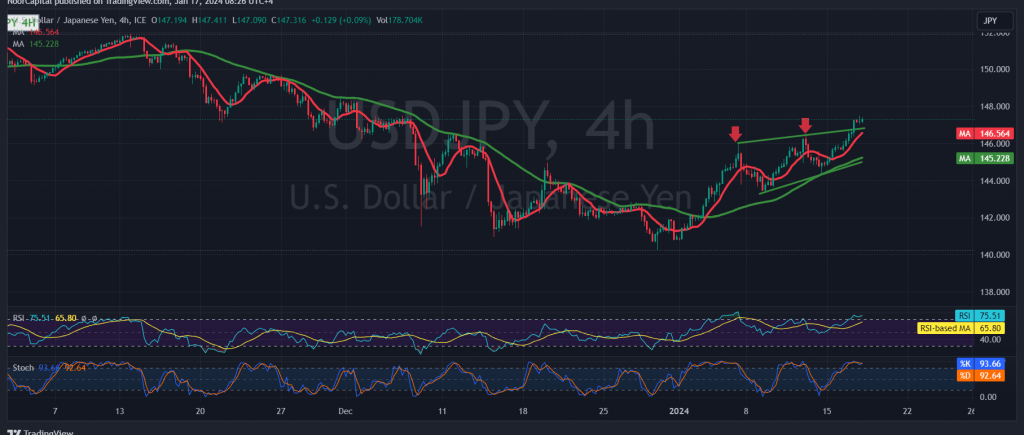

The USD/JPY pair experienced a surge in the previous trading session, aligning with our positive outlook, and reached the designated target at $147.00, marking its peak at $147.47.

From a technical standpoint, the simple moving averages persist in offering positive momentum. Additionally, there are clear positive signals on the 14-day momentum indicator at shorter time intervals, coupled with the breach of the $147.00 resistance.

This enhances the likelihood of the bullish trend continuing during today’s trading session, targeting $148.00 as the initial goal. If breached, the pair’s gains may extend, with the path opening up towards $148.70—an anticipated milestone. Further gains could potentially reach $149.30.

On the downside, the return of trading stability below $146.10 might subject the pair to temporary negative pressure, with the objective of retesting $144.80, possibly hampering further attempts to rise.

Warning: Today, the market is anticipating highly influential economic data from the United States, including “retail sales,” alongside the release of “annual consumer prices” from the United Kingdom. Expect elevated price fluctuations during the news release.

Warning: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations