During the previous trading session, US crude oil futures encountered a psychological resistance barrier at $78.00, which dampened the upward momentum.

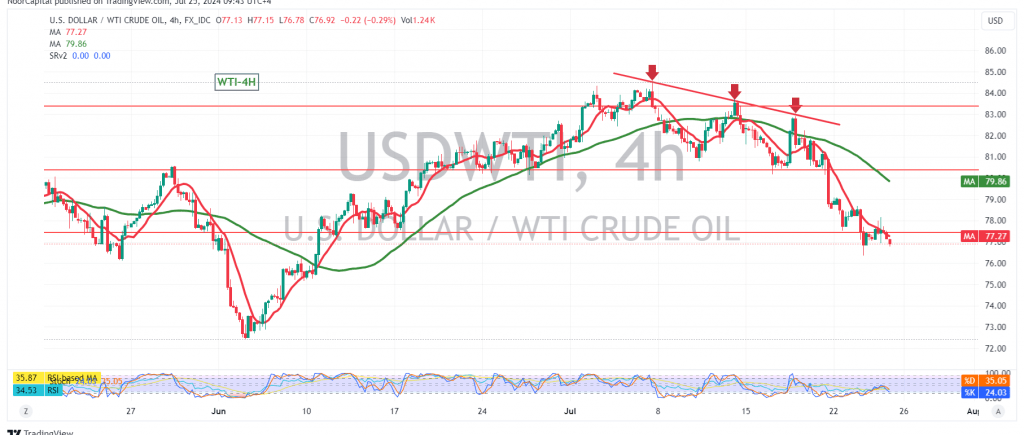

From a technical perspective, today’s outlook leans toward negativity, supported by a bearish technical structure on the 4-hour chart and the simple moving averages indicating ongoing negative pressure from above.

As long as daily trading remains below $78.60, the downward trend is likely to continue, with targets at $76.40 and $75.95. A break below $75.95 could extend losses, potentially leading to a drop towards $75.10, the next key support level.

However, if prices move above and consolidate above $78.60, this would invalidate the bearish scenario, potentially leading to a recovery with an initial target of $79.10.

Warning: The risk level is high.

Warning: Today’s trading session may experience significant price volatility due to high-impact economic data releases from the American economy, including the preliminary GDP reading, annual revenues, and weekly unemployment benefits.

Warning: The level of risk is elevated due to ongoing geopolitical tensions, which could result in substantial price fluctuations.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. The risk level remains high in this market, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations