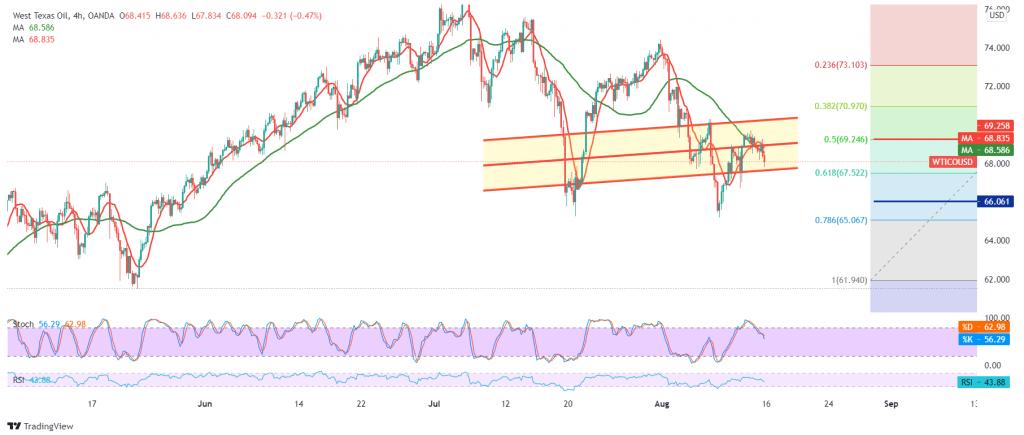

US crude oil futures prices succeeded in achieving the first target required to be touched during the previous trading session, which is located at the price of 67.80, recording the lowest price of 67.76.

Technically, the negative pressure formed by the 50-day moving average supports the bearish trend in prices, in addition to the stability of intraday trading below 68.90 and, in general, below the resistance level of 69.20. Therefore, we are inclined to the negativity towards the second target 67.45 and 66.85, respectively, knowing that the confirmation of the latter’s break extends the oil losses so that the path is directly open towards 66.00.

Skipping the upside and rising again above 69.25 50.0% correction can thwart the bearish scenario completely, and we are witnessing a retest of 69.75, and gains may extend towards the 70.00 barrier.

| S1: 67.45 | R1: 68.90 |

| S2: 66.85 | R2: 69.75 |

| S3: 66.00 | R3: 70.30 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations