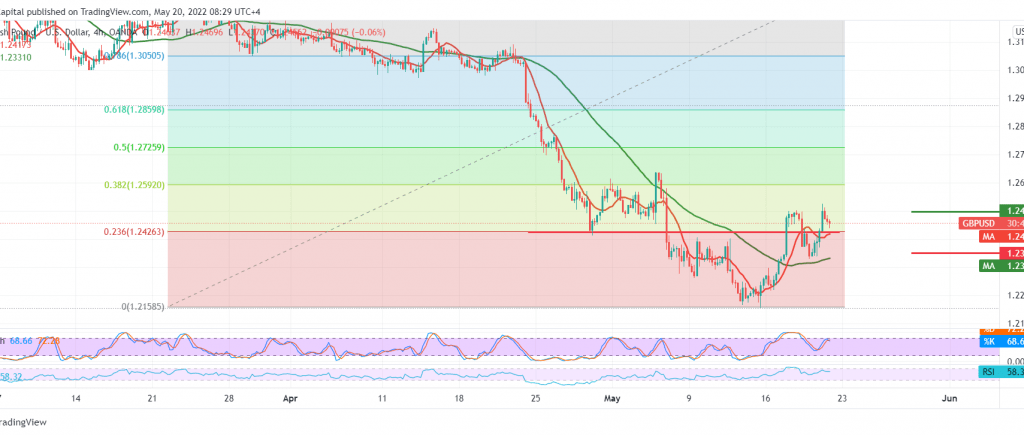

The British pound jumped against the US dollar during the previous trading session after it succeeded in breaching the 1.2430 resistance level, which opened the door for the pair to record gains towards 1.2525.

Technically, we find the pair hovering around the previously breached resistance 1.2430 represented by the 23.60% Fibonacci retracement, and the price is still stable above the 50-day simple moving average, which supports the possibility of continuing the rise; on the other hand, the momentum indicator started to lose the bullish momentum gradually with the decline of the bullish momentum on the short time frames .

Although we tend to have a bearish bias in the coming hours, we want to witness price stability below 1.2430, which paves the way for a retest of 1.2350 as the first target, as long as the price is stable below 1.2500.

To remind that the attempts to consolidate and stabilize above 1.2500 signal to complete the bullish path, with an initial target of 1.2540, and it may extend later towards 1.2580.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations