Negative trading returned to control the movements of the pound sterling against the US dollar after several sessions of successive rise, reaching its highest levels at 1.3744.

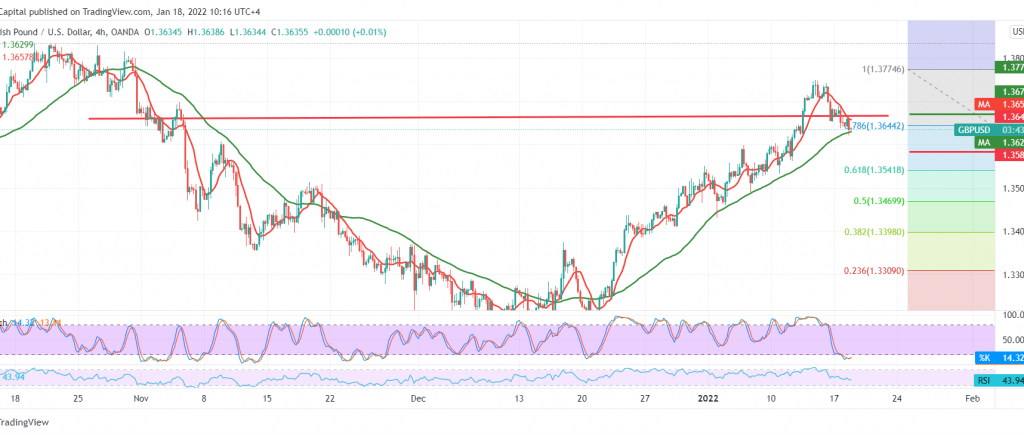

On the technical side today, and by looking at the 4-hour chart, we notice the negative signs coming from the RSI and its stability below the 50 mid-line, in addition to the pair breaking the 1.3670 support level.

Therefore, we may witness a bearish bias in the coming hours, with the first target of 1.3590, knowing that breaking the mentioned level may extend the pair’s losses so that we will be waiting for the next 1.3540 price station.

Activating the proposed scenario depends on trading stability below the level of 1.3670/1.3660. The return of trading stability above it may stop the expected decline and return the pair to recover with the aim of 1.3720.

Warning: CFD trading involves risks; all scenarios may occur.

| S1: 1.3590 | R1: 1.3715 |

| S2: 1.3540 | R2: 1.3790 |

| S3: 1.3470 | R3: 1.3840 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations