We were completely neutral during the previous trading session stating that we were waiting for the BoE’s decision on interest rate setting and monetary policy summary.

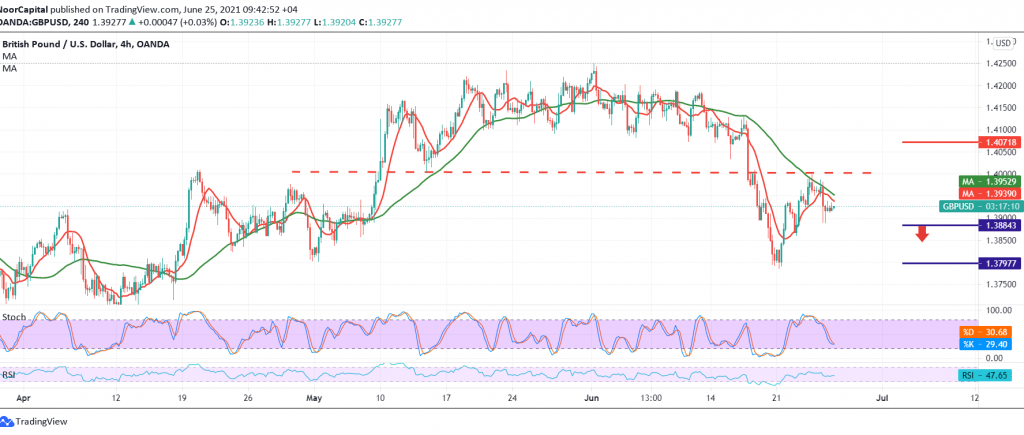

On the technical side, the pound against the dollar witnessed a bearish tendency after hitting the psychological resistance level of 1.4000. we found a contradiction in the technical signals between the negative pressure coming from the 50-day moving average, and the attempts of stochastic to gain additional momentum.

Therefore, we will remain neutral for the moment until the daily trend becomes clearer in a more accurate way, to be in front of one of the following scenarios:

Activating short positions requires that we witness a clear and strong break of the 1.3880 support level, in order to facilitate the task required to visit 1.3840 and 1.3800, respectively. Activating long positions depends on confirming the breach of 1.4000, and from here the pair recovers again, with the target of 1.4075.

| S1: 1.3880 | R1: 1.3980 |

| S2: 1.3840 | R2: 1.4040 |

| S3: 1.3785 | R3: 1.4075 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations