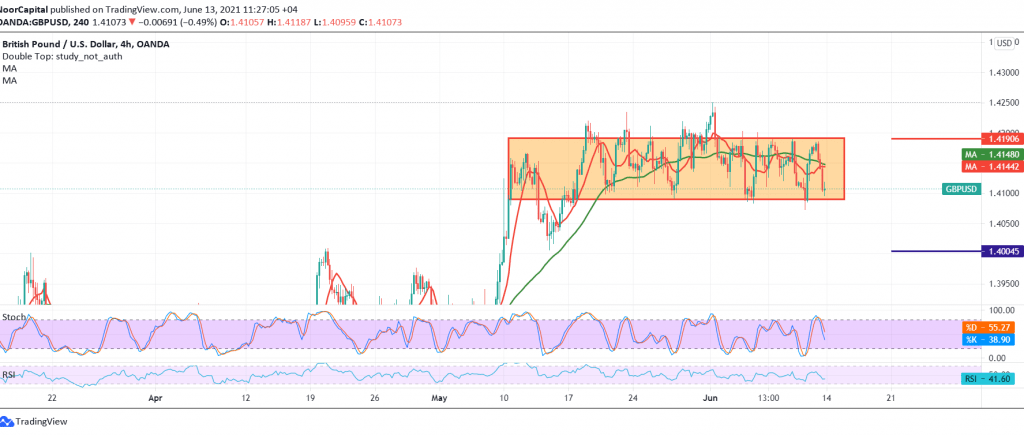

Negative trading dominated the pound sterling against the US dollar after it found it difficult to surpass the major resistance level published during all reports last week at 1.4185, to trade negatively to revisit the pivotal support 1.4090, which we explained previously as the key to protecting the bullish erratic.

On the technical side, we are inclined to the negativity today, relying on the stability of trading below the mentioned resistance, in addition to the negative pressure coming from the simple moving averages.

Although we tend to be bearish, but we prefer to wait for the confirmation of breaking 1.4090, and that extends the pair’s losses, paving the way to visit 1.4040 and 1.4000, respectively.

The return of trading stability above 1.4185, and most importantly 1.4220 negates the activation of the attempts to retreat and leads the pair to the official bullish track again, with an initial target of 1.4260/1.4270 that may extend later towards 1.4320.

| S1: 1.4070 | R1: 1.4185 |

| S2: 1.4040 | R2: 1.4220 |

| S3: 1.3990 | R3: 1.4260 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations