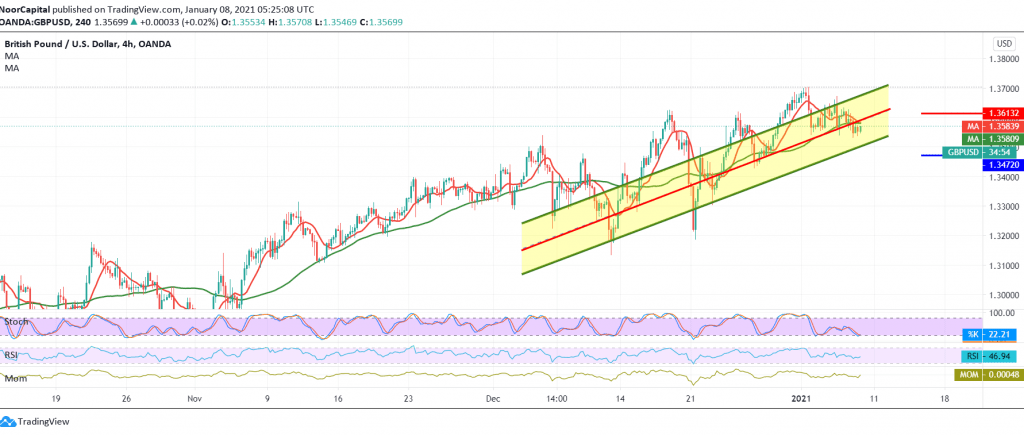

The British Pound succeeded in touching the required target during the previous report, located at 1.3530, Posting a low of 1.3532.

On the technical side, the pair is still showing the bearish tendency due to stability below the psychological barrier resistance of 1.3600, which is accompanied by the negative pressure of the 50-day moving average, which meets around 1.3580 and adds more strength to it.

From here, we keep a negative outlook, continuing towards the second target of the last report 1.3520, and breaking it puts the price under strong negative pressure, its initial target at 1.3475.

From the top, the return of trading above 1.3610 / 1.3620 will immediately stop the bearish scenario, and we will witness a re-test of resistance 1.3675, then 1.3720.

Note: The US employment data are due today and may affect the price.

| S1: 1.3520 | R1: 1.3620 |

| S2: 1.3475 | R2: 1.3675 |

| S3: 1.3415 | R3: 1.3720 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations