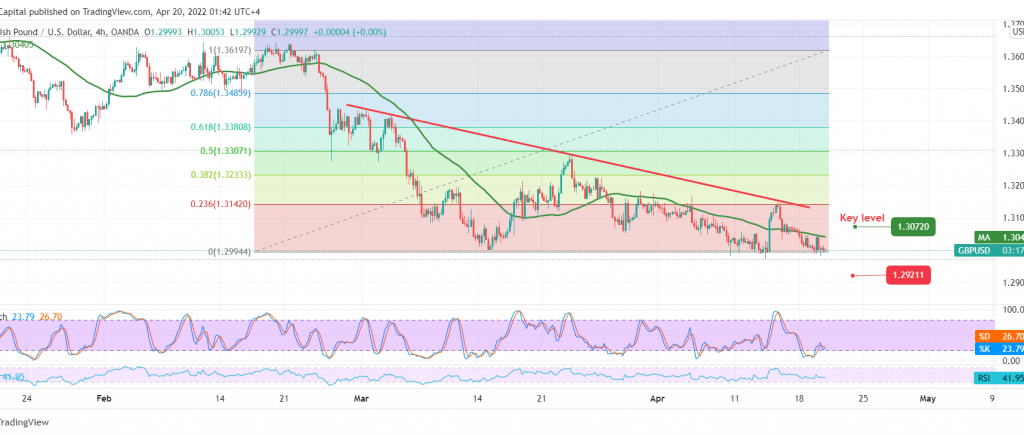

The technical outlook is unchanged, and the pair’s movements did not change significantly, maintaining the negative stability against the US dollar after pressing on the psychological support level of 1.3000.

Technically, we tend to the negativity, relying on the continuation of the intraday movement below the 1.3040 level and, most importantly, 1.3070, accompanied by negative pressure on the price coming from the 50-day moving average to the negativity features that dominate the stochastic indicator.

We await confirmation of breaking the support of the psychological barrier 1.3000, which facilitates the task required to visit 1.2960, a first target. We must pay close attention to this low because a break extends the pair’s losses towards 1.2910 as long as the price is stable intraday below 1.3070, and in general, the general trend in the short term is bearish as long as trading is stable below 1.3145.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.2960 | R1: 1.3040 |

| S2: 1.2905 | R2: 1.3105 |

| S3: 1.2810 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations