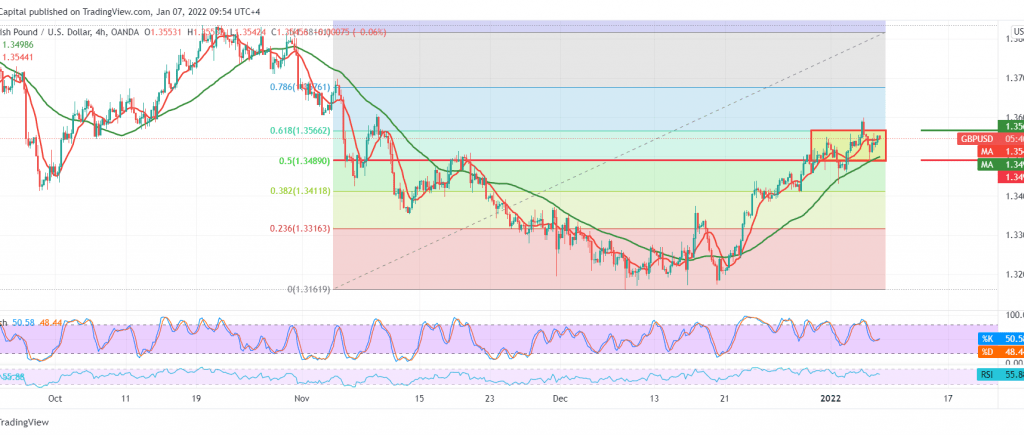

The British pound returned to provide some bullish rebound attempts after building on the support line for the ascending channel at 1.3470, which forced it to settle above the psychological barrier of 1.3500.

On the technical side today, we notice a contradiction in the technical signals between the positive motive of the 50-day moving average and the negative signals that seem clear on the 14-day momentum indicator.

Therefore, we prefer to remain neutral until the daily trend becomes more evident, to be in front of one of the following scenarios:

To continue rising, we need to witness a breach and stability above 1.3570, the main resistance of 61.80% Fibonacci retracement, which increases the possibility of touching 1.3600 and 1.3640, respectively.

Declining below the strong demand point 1.3470, 50.0% correction, leads the pair to return to the bearish bias again, to 1.3420, the awaited price stop initially.

Note: US Jobs Data, average wages, and US unemployment rates are due today and may cause volatility.

Note: all scenarios are on the table.

| S1: 1.3500 | R1: 1.3580 |

| S2: 1.3460 | R2: 1.3640 |

| S3: 1.3420 | R3: 1.3665 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations