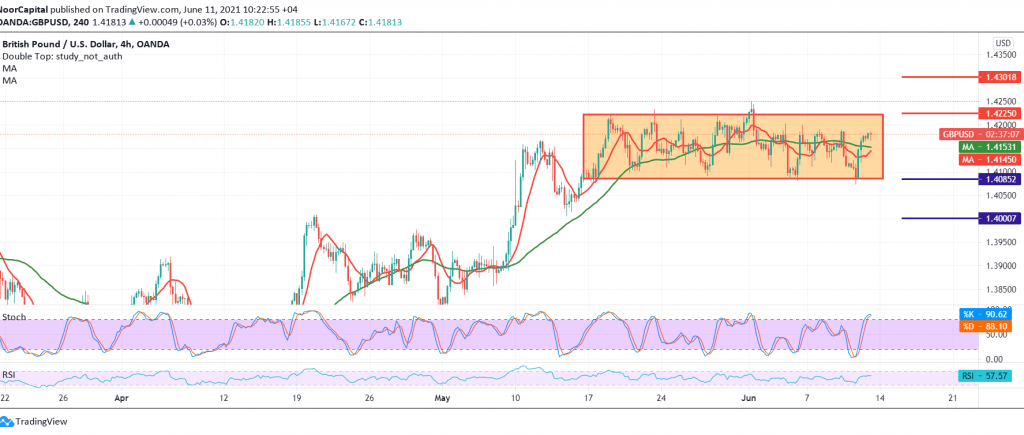

The British pound managed to touch the first target that is required to be achieved during the previous analysis, which is located at the price of 1.4080, to record its lowest price at 1.4073.

On the technical side, the pair found solid support around the mentioned level, which forced it to bounce up and retest 1.4180. Looking at the chart, we find the simple moving averages returned to hold the price from below, and this comes in conjunction with the clear positive signs on the RSI on the short time frames.

Despite the technical factors that support the possibility of a rise, we prefer staying aside, as we mentioned during all the reports of this week, until liberating from the sideways range from below above 1.4080 and from above below 1.4200, to be in front of one of the following scenarios:

Activating long positions requires a breach of 1.4200/1.4220, and that is a catalyst that enhances the chances of rising to visit 1.4270 and 1.4300 respectively. Activating short positions requires that to witness a clear and strong break of the 1.4008 support level, to 1.4000 as a first target.

| S1: 1.4110 | R1: 1.4220 |

| S2: 1.4030 | R2: 1.4260 |

| S3: 1.3990 | R3: 1.4335 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations