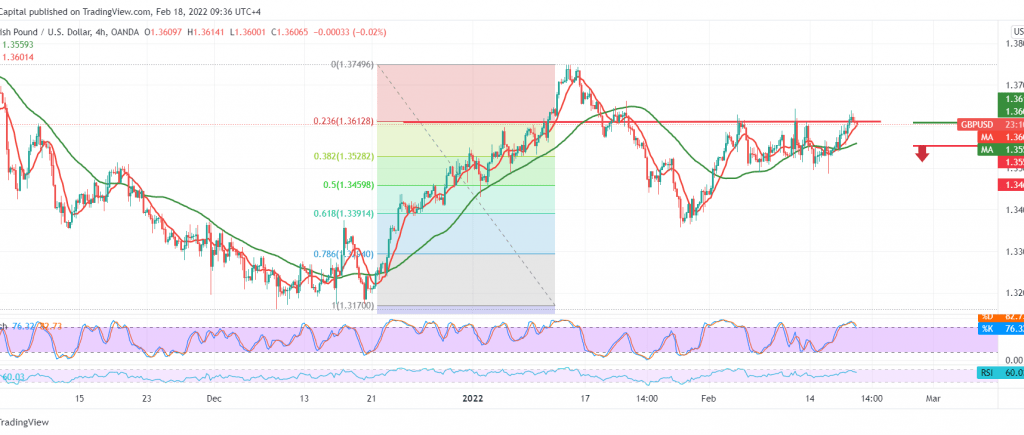

The British pound showed some positive attempts against the US dollar, attacking the pivotal resistance level published during the last analysis at 1.3610, explaining that attempts to breach it might threaten the idea of a decline and lead the pair to visit 1.3650, recording the highest level at 1.3640.

On the technical side, today, the pair is now hovering around the 1.3610 level, 23.60% Fibonacci, as shown on the graph, and we notice that the stochastic indicator has reached oversold areas in the intraday chart, and this contradicts the pair’s continuation of obtaining a positive stimulus from the 50-day moving average.

Therefore, we will monitor the price behavior in the coming hours to determine the next price movement, considering that consolidation above 1.3610 may contribute to consolidating gains towards 1.3650 and may extend later towards 1.3685. At the same time, if the pair fails to cross upwards to the mentioned resistance level, resuming stability below 1.3565, that renews the bearish bias to visit 1.3500 and 1.3460, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3565 | R1: 1.3650 |

| S2: 1.3500 | R2: 1.3685 |

| S3: 1.3460 | R3: 1.3735 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations