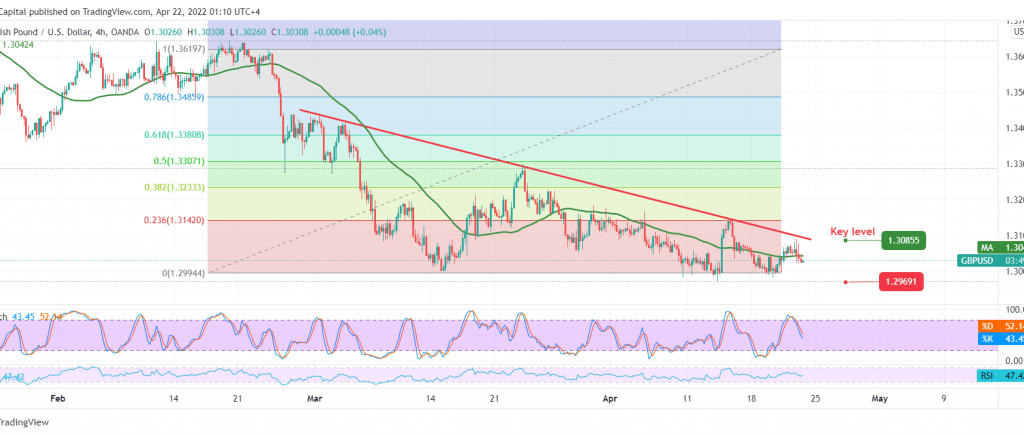

We adhered to neutrality during the previous analysis, explaining the necessity of observing the price behavior of the pound around the 1.3080 resistance level due to its importance for the general trend in the short term, and succeeded in limiting the bullish bias and forced the pair to trade negatively again.

Technically, the most likely scenario is still the downside, relying on the stability of daily trading below 1.3080 and the negative pressure of the 50-day simple moving average.

It should be noted that the bearish tendency requires confirmation of breaking 1.3000, to facilitate the task needed to visit 1.2965, knowing that the 1.2965 level is pivotal, and if it is broken, it will extend the pair’s losses, so we will be waiting for 1.2930.

Consolidation above 1.3080 can stop the above-suggested scenario and lead the pair to attack 1.3120 and 1.3170 as the next station.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3015 | R1: 1.3095 |

| S2: 1.2965 | R2: 1.3120 |

| S3: 1.2935 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations