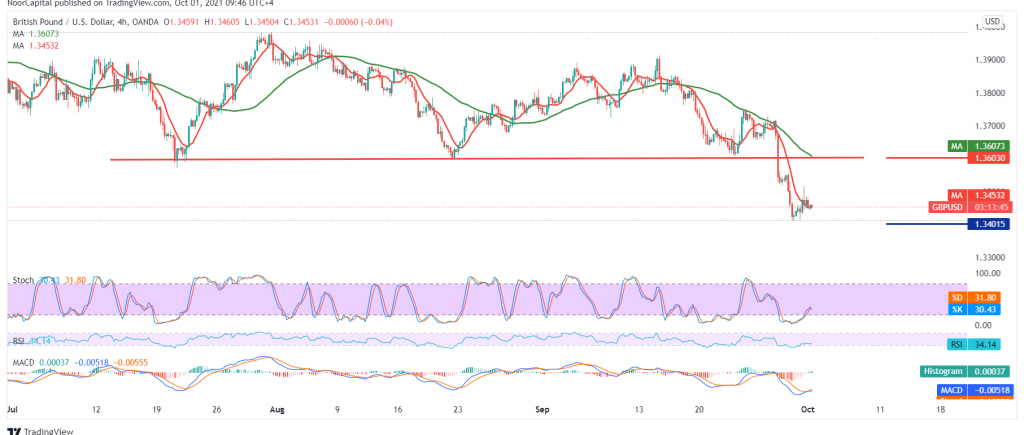

The British pound incurred heavy losses during two trading sessions in a row after it failed to maintain trading above the 1.3600 support level, to record its lowest level at 1.3452.

On the technical side today, we notice a conflict between the technical signals, and we found stochastic trying to provide positive crossover signals, and that contradicts the continuation of the negative pressure coming from the 50-day moving average.

Therefore, we will remain neutral for the moment until the daily trend becomes clearer, waiting for the following scenarios

Reactivating the long positions depends on confirming the breach of the resistance level 1.3510, which increases the possibility of retesting 1.3565 and then 1.3610, respectively.

Continuing to activate short positions requires that we witness a break and stability of the price below 1.3450, and from here the pair resumes the official descending path, with the first target of 1.3400, and losses may extend later towards 1.3360.

| S1: 1.3400 | R1: 1.3510 |

| S2: 1.3360 | R2: 1.3565 |

| S3: 1.3305 | R3: 1.3620 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations