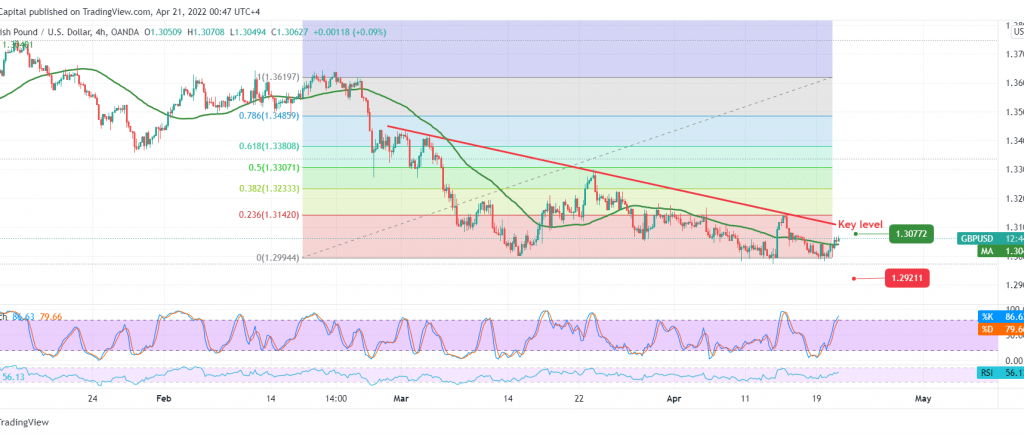

We indicated during the previous analysis that activating the bearish scenario depends on confirming the breach of the psychological barrier 1.3000 as the pair closes above for the 2nd session, rebounding to the upside to retest the 1.3070 level.

Technically, the stability of trading above 1.3000 leads to the possibility of continuing the limited rise, accompanied by the positive motive for the 50-day moving average, which returned to hold the price from below. Therefore, it is better to monitor the pair’s price behavior around the pivotal resistance 1.3080/1.3070 because breaching it may enhance the chances of rising towards 1.3120 and 1.3170 before descending again as long as the price is above 1.3000.

Declining below 1.3000 The bearish trend returns to control the movements of the Pound Sterling to be waiting for the official bearish target of 1.2930.

Note: Today, we are awaiting the Federal Reserve’s speech later in today’s session, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.3015 | R1: 1.3095 |

| S2: 1.2965 | R2: 1.3120 |

| S3: 1.2935 | R3: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations