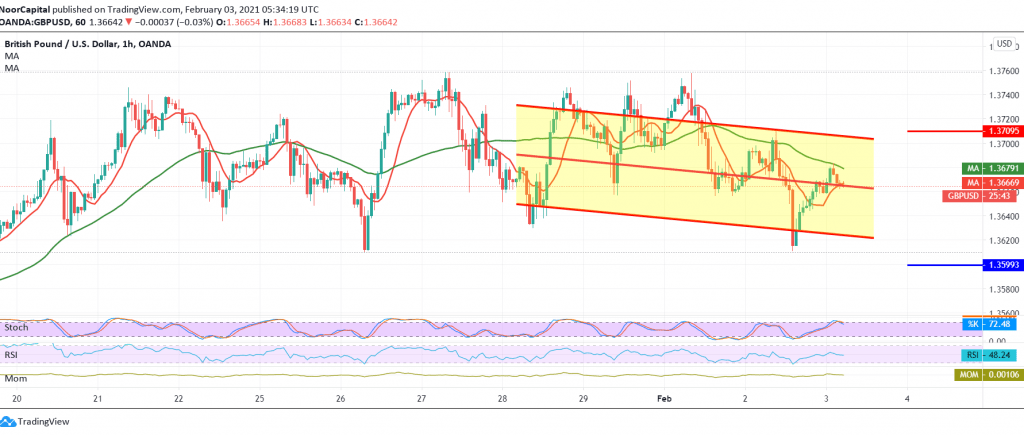

Negative trading dominated the pound’s moves against the US dollar within the technique of retesting the support, as we mentioned during the previous analysis, touching the required target 1.3650, recording the lowest price at 1.3610.

On the technical side, the current moves are witnessing stability again above the support floor of 1.3650, the 50-day moving average is still pressing the price from the top, in addition to the stochastic gradually losing the bullish momentum.

We tend to be negative in our trades, but cautiously, knowing that confirming a break of 1.3610 puts the price under negative pressure, targeting 1.3560 and extending to 1.3510.

Trading again above the pivotal resistance 1.3710, which is considered one of the most important keys to the trend. It will stop the bearish scenario, and we may witness an upward intraday path targeting 1.376.

Note: The risk level may be high today.

| S1: 1.3615 | R1: 1.3710 |

| S2: 1.3560 | R2: 1.3760 |

| S3: 1.3510 | R3: 1.3810 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations