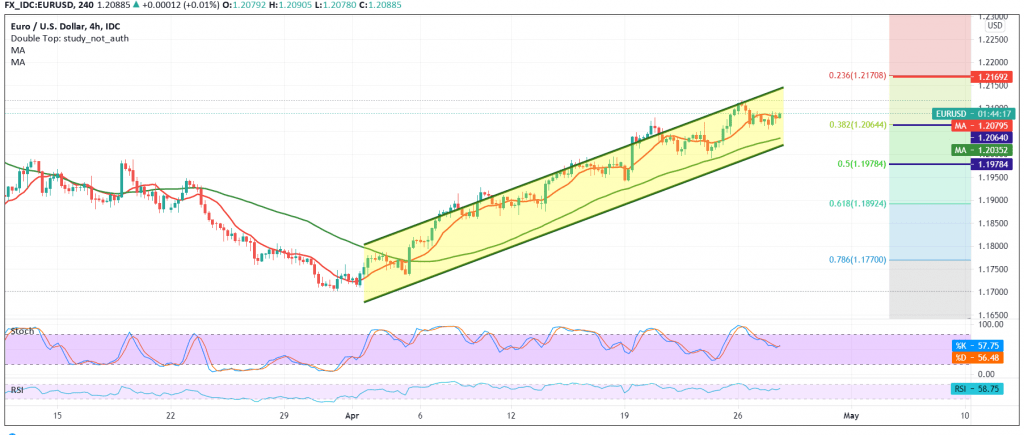

The euro traded quietly against the US dollar within sideways trading, through which the pair succeeded in re-testing the support level mentioned in the previous analysis at 1.2060.

Technically speaking, by looking at the 4-hour chart, we find the euro is stable intraday above 1.2060 Fibonacci retracement 38.20% and generally above 1.2030 accompanied by the positive stimulus of the 50-day moving average that continues to hold the price from below, and on the other hand, we find the euro stable below Resistance level 1.2110 under negative pressure from stochastic.

With the conflict of technical signals and the decline in trading between the aforementioned levels, we will stand on the fence for the second session in a row to obtain a high quality deal, to be in front of one of the following scenarios:

To get a bullish trend, the euro should maintain stability above 1.2060 and most importantly 1.2030. We also need to witness the breach of 1.2110 / 1.2120 in order to enhance the chances of a bullish move towards 1.2170, a next target represented by the 23.60% correction.

Activating short positions comes with the confirmation of a 1.2030 break, which puts the price under strong negative pressure, targeting 1.1975 a 50.0% correction.

| S1: 1.2030 | R1: 1.2135 |

| S2: 1.1975 | R2: 1.2175 |

| S3: 1.1925 | R3: 1.2235 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations