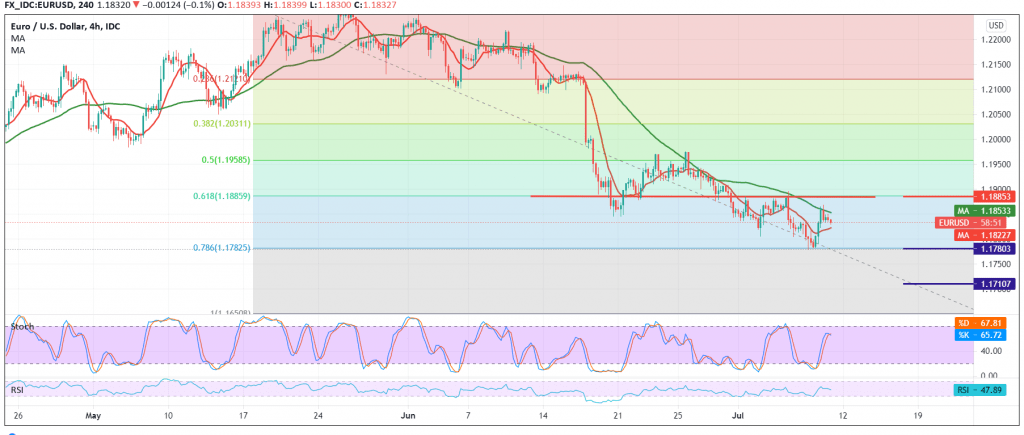

The movements of the euro against the US dollar witnessed a slight bullish tendency, trying to stabilize above the support level of 1.1780, and the pair is now hovering around its highest level during the morning trading of the current session 1.1837.

On the technical side today, despite the bullish bias, it is still limited, to find the 50-day moving average that is still a hindrance and converges around the 1.1860 resistance level and adds more strength to it, in conjunction with the negativity signs that started to appear on the stochastic indicator.

Therefore, we keep our negative outlook, targeting 1.1790, a first target, and then 1.1745, a second target, knowing that the official target for the current downside wave is 1.1710.

Only from the top is the upside move and the price stability above 1.1885, the 61.80% Fibonacci correction is able to postpone the bearish scenario, and we witness positive trades that aim to retest 1.1930 initially.

| S1: 1.1790 | R1: 1.1885 |

| S2: 1.1745 | R2: 1.1930 |

| S3: 1.1700 | R3: 1.1975 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations