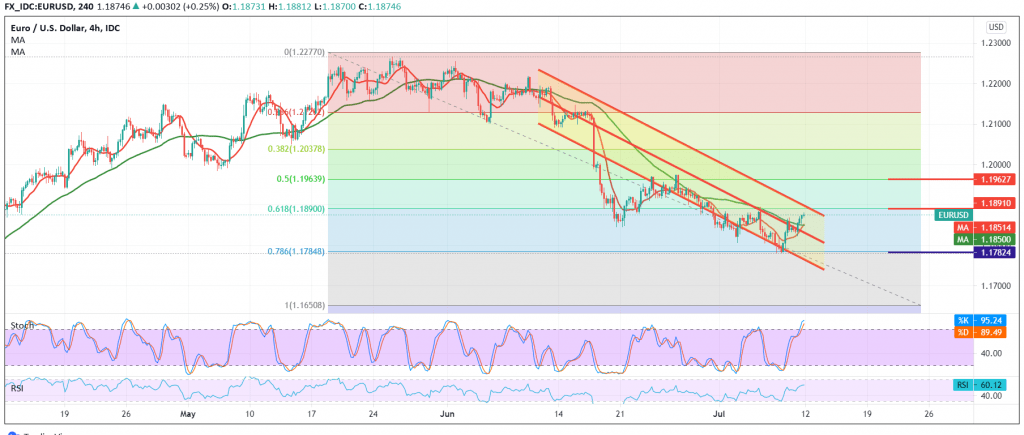

EURUSD is seeing attempts to rally after it found a good support floor near 1.1780 and despite the rallies, we think it is still limited.

Technically, by looking at the 4-hour chart, we find that there is a conflict between the positive motive coming from the 50-day moving average, which is trying to push the price to the upside, and the clear negative features on the stochastic indicator.

With the technical signals conflicting, we prefer to stand aside until the daily trend becomes clearer, to be in front of one of the following scenarios: Activating long positions requires that we witness a clear and strong breach of the resistance level 1.1885/1.1890, Fibonacci correction of 61.80%, and that is a catalyst that increases the possibility of retesting 1.1930 and then 1.1975.

Activating short positions requires confirming the breach of 1.1820/1.1810, and from here the bearish trend returns to control the euro’s movements in full, targeting 1.1780 and 1.1750, respectively, and losses may extend later to visit 1.1710.

The Euro is trying to recover, waiting for a signal to confirm the trend

| S1: 1.1810 | R1: 1.1930 |

| S2: 1.1750 | R2: 1.1975 |

| S3: 1.1710 | R3: 1.2010 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations