The single European currency succeeded in achieving the gradual rise target referred to during the previous report, at 1.1330, recording its highest level at 1.1354, benefiting from the strong demand level of 1.1260.

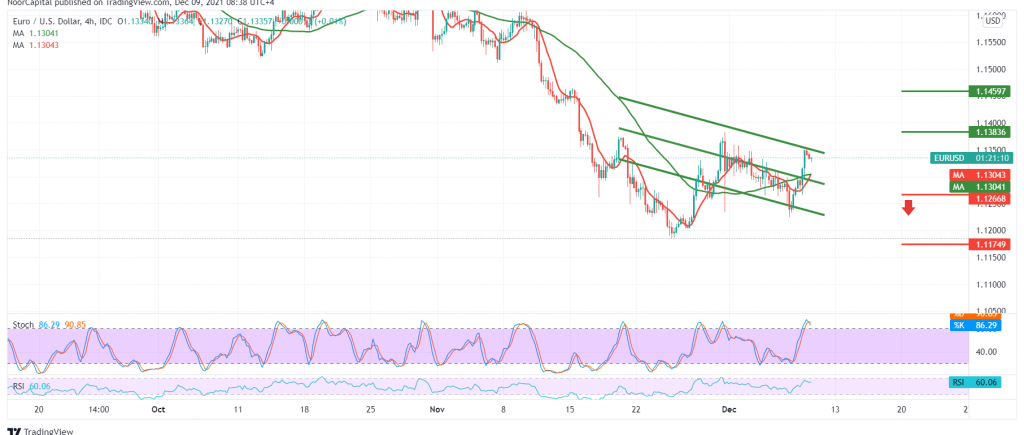

Technically, today, and with careful consideration on the 4-hour chart, we notice that the moving averages continue to provide a more positive motive, supporting the continuation of the temporary bullish path. On the other hand, we find Stochastic around the overbought areas.

We prefer staying neutral for the moment due to the conflicting technical signals to maintain the profitability rates that were achieved yesterday so that we are facing one of the following scenarios:

The price behavior should be carefully monitored around the pivotal supply point 1.1380/1.1375 due to its importance for the current trading levels if the euro succeeds in breaching it. This will extend the gains to visit 1.1400 first target then 1.1460 next.

Suppose the euro fails to cross upwards to the mentioned resistance level, re-establishing stability below 1.1260 from here. In that case, the negative pressure will start on the pair and return to the descending path, with the first target of 1.1200 and 1.1175, awaited price targets.

| S1: 1.1280 | R1: 1.1370 |

| S2: 1.1220 | R2: 1.1400 |

| S3: 1.1175 | R3: 1.1460 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations