The European currency witnessed typical trading during the previous trading session to test the bullish target of 1.0485, recording the highest level at 1.0510, and returning to the main bearish trend again, approaching a few points from the official descending station at 1.0350, recording its lowest level at 1.0360.

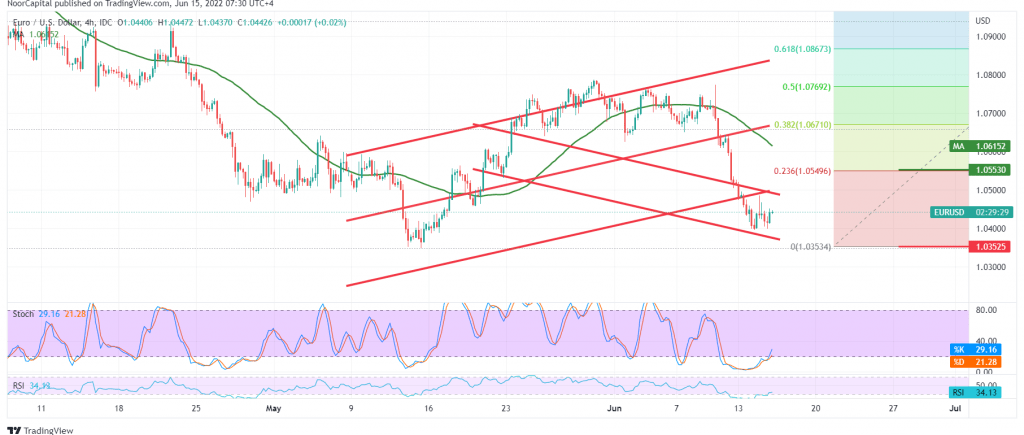

Technically today, and with a careful look at the 4-hour chart, we notice that the pair achieved a bullish bounce after touching 1.0360 and is now hovering around the highest level during the early trading of the current session at 1.0450; looking at the chart, the 50-day simple moving average still constitutes an obstacle to the pair in addition to The appearance of negative signs on Stochastic, which started to gradually lose the bullish momentum.

With intraday trading remaining below 1.0510, and most importantly 1.0550 represented by the 23.60% Fibonacci correction, the bearish scenario remains the most likely, knowing that the decline below 1.0350 extends the pair’s losses, opening the door to 1.0300 as a next descending station that may boost its targets later towards 1.0210.

Consolidation above 1.0550 might temporarily stop the bearish trend, and we witness a bullish corrective slope with a target of 1.0670, a 38.20% correction.

Note: The BoE monetary policy summary is due today, and we may witness price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0370 | R1: 1.0520 |

| S2: 1.0290 | R2: 1.0590 |

| S3: 1.0210 | R3: 1.0670 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations