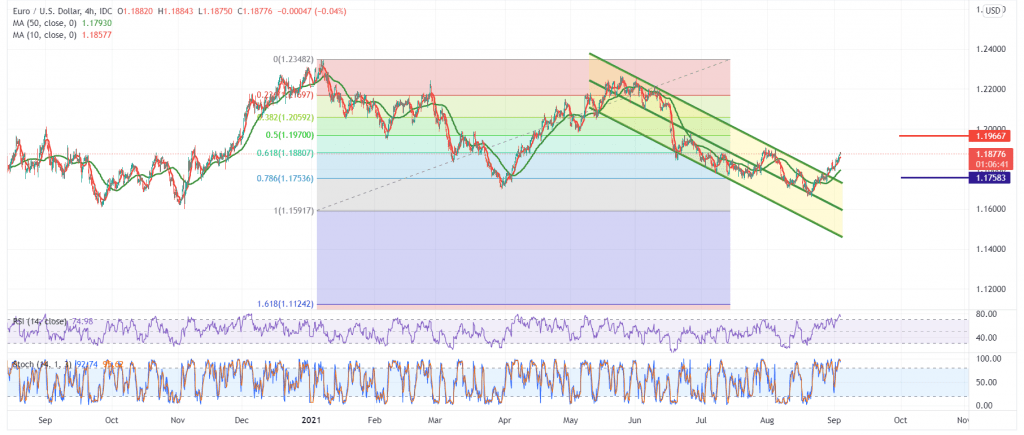

Positive trading dominated the euro’s movements against the US dollar within the expected bullish context during the previous analysis, touching the official target to be achieved at 1.1880, recording the highest level at 1.1884.

Technically, the stability of trading above the intraday level above 1.1840/1.1820 supports the continuation of the rise and the continuation of the pair getting positive stimulus from the 50-day moving average, which meets near the psychological barrier of 1.1800.

On the other hand, we find the pair hovering around the pivotal resistance 1.1880 represented by the 61.80% Fib, which represents one of the daily trend keys. We notice that the stochastic indicator has reached the overbought areas.

Therefore, we prefer to remain neutral and monitor the price behavior of the pair around the mentioned levels in order to maintain profitability rates and to obtain a high-quality deal waiting for one of the following scenarios:

The breach of the euro and the price stability above 1.1880 increases the strength of the bullish trend to achieve more gains to visit 1.1930 and 1.1970 50.0% correction, respectively.

While if the pair fails to breach the mentioned level, resuming stability below 1.1800 puts the price under negative pressure once again, and its targets start around 1.1765 & 1.1720.

| S1: 1.1840 | R1: 1.1930 |

| S2: 1.1765 | R2: 1.1970 |

| S3: 1.1720 | R3: 1.2060 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations