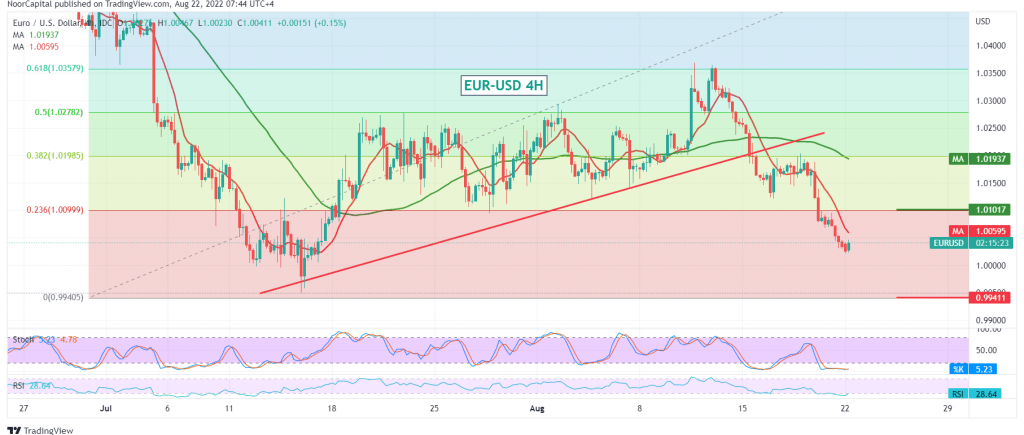

A strong bearish trend dominated the movements of the euro against the US dollar at the end of last week’s trading, within the expected negative outlook, heading to touch the official price target station at 1.0040, recording the lowest level at 1.0023.

Today’s technical outlook indicates the possibility of resuming the decline, with the continuation of the negative crossover of the simple moving averages that continue to support the general bearish curve of prices, in addition to confirming the breach of the psychological support of 1.0100, which is now turned into a resistance level.

Therefore, the possibility of touching 1.0000 is still valid and effective and may extend to a visit. However, it should be noted that the attempt to break 0.9980 increases and accelerates the downside force so that we will be waiting for 0.9940 next station unless we witness a return to the price above 1.0080 and, most importantly, 1.0100.

Stability above 1.0100 postpones the idea of the decline, and the euro temporarily recovers to retest 1.0170 before resuming the decline.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9980 | R1: 1.0080 |

| S2: 0.9935 | R2: 1.0130 |

| S3: 0.9900 | R3: 1.0170 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations